Melbourne's Undervalued Suburbs: Your 2025-2026 Investment Guide

Discover Melbourne's hidden property gems poised for significant growth in the upcoming market super-cycle. Leverage data to identify high-potential, undervalued suburbs before they boom.

The Investor's Dilemma: Finding True Value in a Shifting Market

Navigating the Australian property market requires more than just capital; it demands a strategic understanding of value. A common market dynamic, the 'Good, Better, Best' principle, illustrates that at certain price points, it becomes more advantageous to invest in a superior neighbouring suburb rather than overpaying in a familiar one. This creates market inefficiencies—gaps where savvy investors can find undervalued properties with immense growth potential. Identifying these opportunities is the key to maximising returns.

This guide delves into the Melbourne property market, which is currently presenting one of the most significant investment opportunities in Australia. We'll explore the suburbs that are severely undervalued and poised to boom in the predicted 2025-2026 super-cycle, giving you the insights needed to make data-driven decisions.

Why Melbourne is Primed for a Property Boom

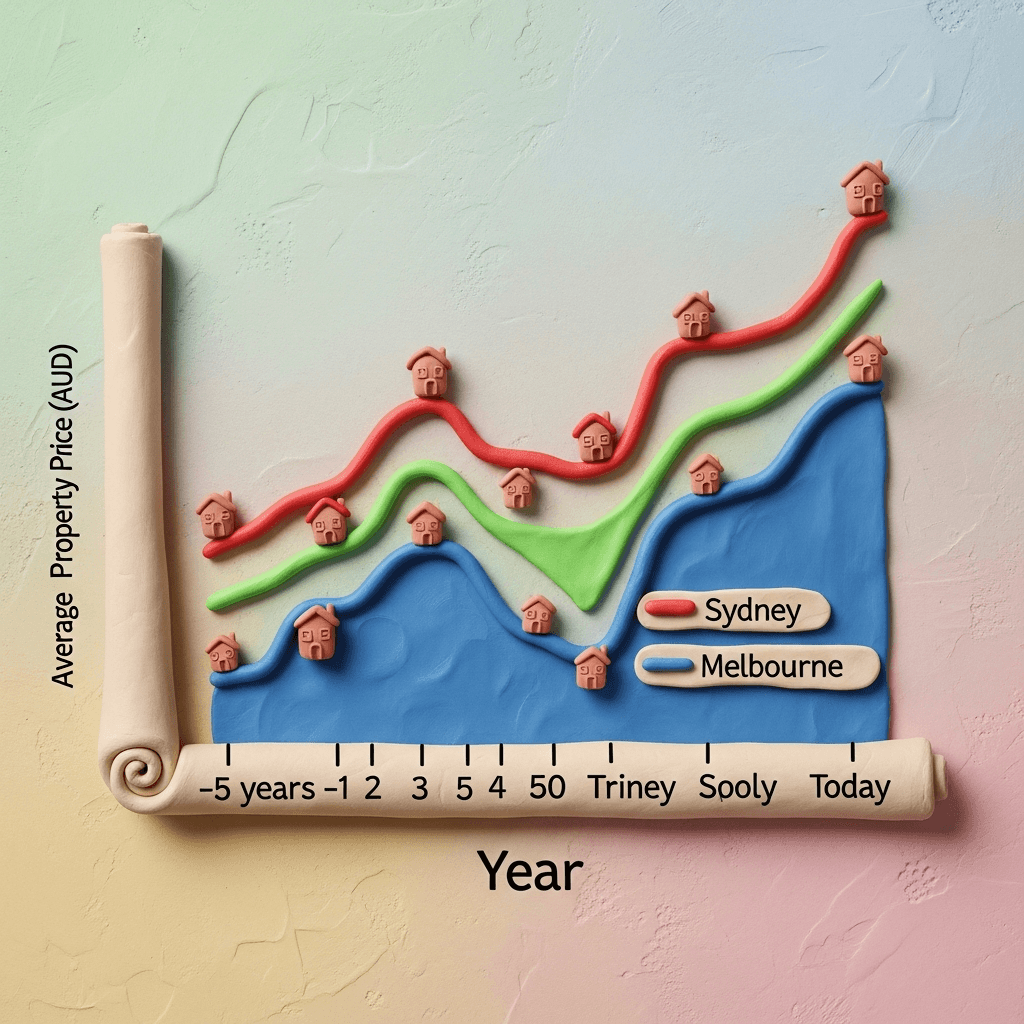

After a period of slower growth compared to other capitals, Melbourne's property market is set for a significant correction. The price gap between Melbourne and Sydney is at an unprecedented high, making Melbourne an attractive and comparatively affordable entry point for investors. With a median house price significantly lower than Sydney's, there is substantial room for growth as the market inevitably catches up.

Several key factors are aligning to fuel this impending boom:

Interest Rate Cuts: We are entering a rate-cut cycle. Historically, periods of decreasing interest rates have consistently led to substantial increases in property prices, often double-digit growth within two years.

Market Recovery: Melbourne has lagged behind other capital cities, which saw an average increase of 45% over five years compared to Melbourne's 19.2%. This gap is unsustainable and signals a powerful rebound is on the horizon.

Rental Market Strength: Melbourne's rental market is booming, with rents in some key areas increasing by 30-40% in a single year. This provides strong rental yields for investors, making properties cash flow positive or neutral while they appreciate in value.

Government Incentives: Upcoming schemes, such as the 5% first home buyers grant with no LMI, will inject further demand into the market, particularly for properties under the $950,000 threshold.

To make sense of these complex market dynamics, investors need powerful tools. HouseSeeker’s Real Estate Analytics Hub provides the comprehensive data required to track trends and compare suburb performance effectively.

Uncovering Melbourne's Undervalued Hotspots

Identifying the right suburb requires a tiered approach, as 'undervalued' exists at every price point. We've categorised our top picks based on budget to help you target your search.

Top-Tier Undervalued Suburbs (Premium Market)

These suburbs offer prestige and consistent long-term growth. They are already expensive but are currently undervalued relative to their 'best' counterparts.

Ashburton: Known for its family-friendly atmosphere and proximity to top-tier schools like Ashwood High and Caulfield Grammar. It offers excellent connectivity and access to Chadstone Shopping Centre.

Balwyn North: Despite strong growth, it remains a value proposition compared to Balwyn proper. With access to Doncaster Shopping Centre and elite schools, it's a prime target for high-income families.

Glen Iris: A classic top-10 suburb that has become undervalued as neighbouring Toorak and Malvern have surged. Its proximity to the city, Chapel Street, and premium schools makes it a blue-chip investment.

Aspirational Undervalued Suburbs (Mid-Range)

These suburbs provide an excellent balance of lifestyle, affordability, and growth potential, making them ideal for investors looking to expand their portfolios.

Brighton East: Offers the coveted Bayside lifestyle at a more accessible price point than Brighton proper. The value gap between these two suburbs is widening, presenting a clear opportunity for capital growth.

Box Hill South & Doncaster: These areas are benefiting from the ripple effect of their booming neighbours. They offer solid infrastructure, good schools, and are increasingly popular with young professionals and families.

Affordable High-Growth Suburbs

For investors seeking accessible entry points with high growth ceilings, these suburbs are undergoing significant transformation and are currently undervalued.

Burwood East: Often overlooked in favour of Burwood, this suburb offers excellent value with strong fundamentals and growing demand.

Reservoir: Transitioning from a blue-collar area to a vibrant, leafy suburb. With large blocks, mature trees, and proximity to universities, it's attracting a new demographic of young professionals, driving property values up.

Altona North: Home to one of Melbourne's best new land estates, this suburb is only 11km from the CBD. Finding a house and land package under a million dollars this close to the city is an opportunity that won't last.

Finding the perfect property in these diverse areas is easier with advanced tools. The HouseSeeker AI Property Search allows you to use natural language to find homes that match your specific investment criteria, from school zones to gentrification potential.

The Power of Gentrification: Identifying Future Hotspots

Gentrification—the process where more affluent residents move into a lower-income area, driving up property values and transforming the neighbourhood's character—is one of the most powerful forces for capital growth. The key is to invest before the transformation is complete.

Our top picks for gentrification hotspots in Melbourne are:

1. Heidelberg West, Heidelberg Heights & Bellfield: This cluster is the number one gentrification opportunity. Surrounded by affluent suburbs like Ivanhoe and Eaglemont, it boasts excellent parks, a major hospital precinct, and La Trobe University. It is the cheapest area in a highly desirable pocket of Melbourne, and the demographic shift is already underway. 2. Sunshine North: Benefiting from its proximity to the city and significant infrastructure investment, Sunshine North is rapidly shedding its industrial past. As young professionals are priced out of the inner west, this suburb is becoming the next frontier for growth.

The process of identifying and securing a property in a rapidly changing suburb can be complex. An AI Buyer's Agent can provide personalised recommendations and guide you through every step, ensuring you capitalise on these fleeting opportunities.

Conclusion: Seize the Melbourne Opportunity

The Melbourne property market is at a critical inflection point. The combination of market fundamentals, historical trends, and a growing price disparity with other capitals has created a perfect storm for investors. By focusing on undervalued suburbs across different price points—from premium locations like Glen Iris to gentrifying hotspots like Heidelberg West—you can position yourself for substantial gains in the 2025-2026 super-cycle.

Success lies in combining strategic insight with powerful data. By looking beyond the obvious and identifying where true value lies, you can build a robust property portfolio that delivers long-term wealth.

Ready to uncover Melbourne's next property hotspot? Explore in-depth suburb data and market forecasts on the HouseSeeker Real Estate Analytics Hub and start making smarter investment decisions today.

Frequently Asked Questions

Why is Melbourne's property market expected to boom in 2025-2026?

Melbourne's market is poised for a boom due to several factors: a large and growing price gap with Sydney, the beginning of an interest rate cutting cycle which historically fuels price growth, strong rental demand, and a post-COVID economic recovery. The market has underperformed compared to other capitals, making it primed for a significant upward correction.

What is the 'Good, Better, Best' principle in real estate?

This principle describes a market inefficiency where, at a certain price, it becomes more financially prudent to buy in a superior adjacent suburb ('better' or 'best') rather than overpaying for a top-end property in a lesser suburb ('good'). For example, instead of buying a $2.5 million home in Bentleigh, an investor might find a comparable or better property for the same price in the more prestigious Brighton East, offering greater potential for capital growth.

What is the difference between gentrification and rejuvenation?

Gentrification is a specific socio-economic process where an influx of wealthier individuals and businesses displaces existing, lower-income residents in a neighbourhood, leading to a rapid increase in property values and rents. Rejuvenation is a broader term for general improvements to an area, such as government investment in parks or infrastructure, which may or may not involve a significant demographic shift.