The Myth of the Perfect Suburb: An Investor's Guide to Data-Driven Decisions

Stop searching for a flawless suburb and start using key data metrics to identify high-potential investment areas without the analysis paralysis.

The Search for Investment Perfection

For many Australian property investors, the journey begins with a quest for the 'perfect' suburb. This idealised location often features tree-lined streets, quiet parks, and a strong sense of community. However, for a savvy investor, perfection isn't about lifestyle—it's about measurable performance. The true goal is to find areas offering high growth, low risk, and strong cash flow, a trifecta that can only be identified through objective data, not emotion.

Escaping the Trap of Analysis Paralysis

The modern investor is bombarded with information: glowing reports about new infrastructure, hotspot lists from so-called experts, and endless market noise. This overload often leads to 'analysis paralysis,' where the fear of making the wrong decision results in no decision at all. It's easy to get bogged down by conflicting advice and minor negative details, causing you to miss out on real opportunities. The key is to understand that no suburb will tick every single box perfectly; even the highest-performing markets have trade-offs.

The Data Points That Drive Real Growth

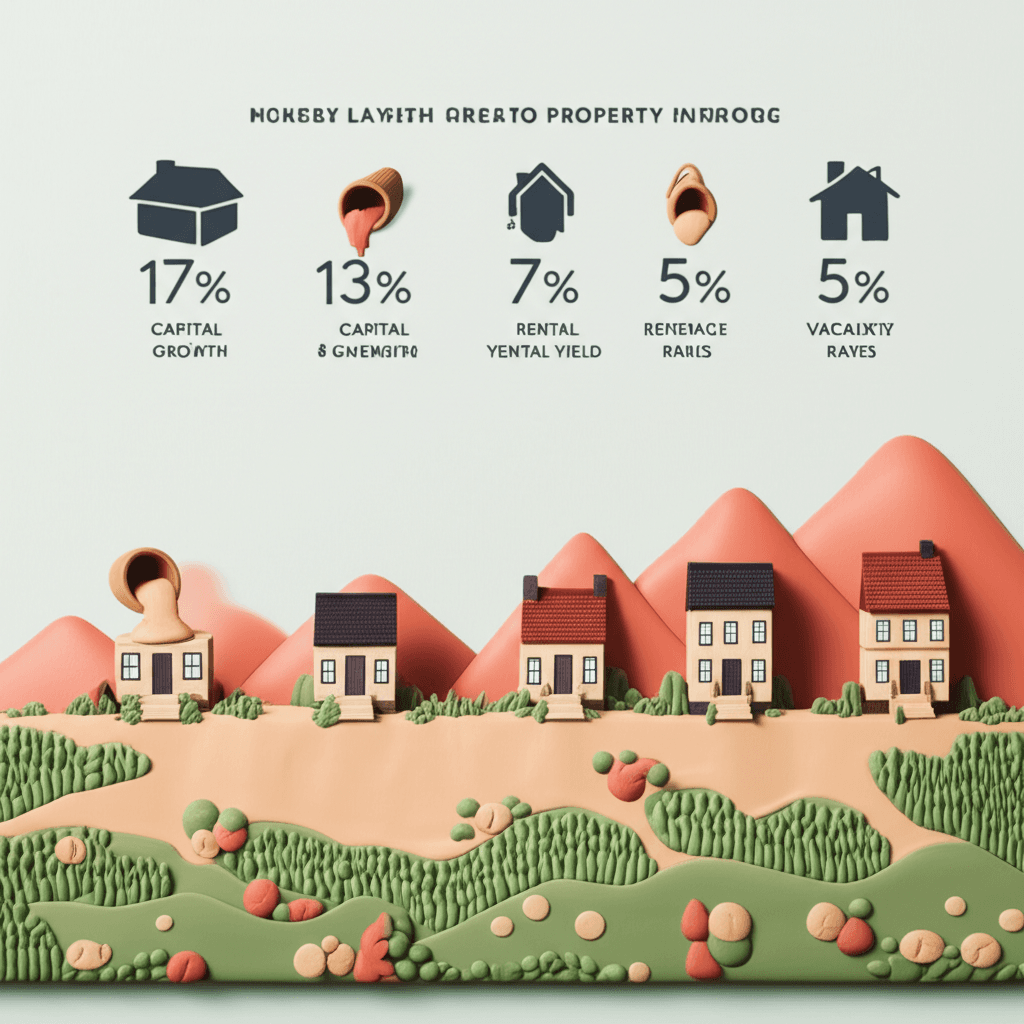

To move beyond the hype, you must focus on the core metrics that reveal a market's true potential. While a sophisticated algorithm might use over 30 data points, a few fundamentals provide a clear picture of a suburb's health. The goal is to find a powerful combination of factors that point towards sustained growth. A comprehensive real estate analytics platform is essential for this process.

Key metrics to analyse include:

Demand to Supply Ratio (DSR): This is a critical indicator of market pressure. A high DSR score suggests that demand from buyers is significantly outpacing the number of properties available, which typically drives prices up.

Vacancy Rates: A tight vacancy rate (ideally well below 2%) indicates strong tenant demand. This not only secures your rental income but also fuels rental growth.

Stock on Market: A low percentage of properties listed for sale shows that owners are holding onto their assets, limiting supply and creating a competitive environment for buyers.

Market Cycle Timing: Don't automatically dismiss a market that has seen recent growth. Property cycles vary, and strong momentum can continue. The crucial element is to analyse long-term performance and underlying drivers to ensure the growth is sustainable.

Understanding Trade-Offs and Data Reliability

Even suburbs with stellar data will have perceived negatives, such as higher crime rates, public housing, or proximity to main roads. However, these factors are often already priced into the market and may have little to no impact on long-term capital growth. What's more important is the quality of your data. A suburb might show a fantastic DSR score, but if the statistical reliability of that data is low due to a small number of sales, it's a red flag. Always prioritise markets where the data is robust and reliable, giving you the confidence to invest.

From the Right Suburb to the Right Property

Once you've identified a cluster of high-potential suburbs, the focus shifts to selecting the right property. While a service like an AI buyer's agent can streamline this process, every investor should understand the core principles of a great investment asset.

Forget chasing elusive 'undermarket value' deals in cold markets. In a rising market, it's better to pay a fair price to secure an asset that will grow. The most critical factor is the Land-to-Asset Ratio. You want the majority of the property's value to be in the land, not the building. A property on a large block with a high land value has the greatest potential for long-term capital appreciation. Other positive attributes include a functional layout, value-add potential through minor renovations, and low maintenance requirements.

Conclusion: Embrace Data, Not Perfection

The pursuit of the perfect property in the perfect suburb is a flawed strategy that leads to missed opportunities. The reality is that all investments involve calculated risks and trade-offs. By shifting your mindset from chasing an ideal to making data-driven decisions, you can minimise risk and build a successful portfolio.

Focus on identifying suburbs with strong, reliable data indicating high growth potential. Within those suburbs, prioritise properties with a high land-to-asset ratio. This disciplined, analytical approach is the true path to long-term property investment success.

Ready to stop guessing and start analysing? Use HouseSeeker's powerful real estate analytics tools to uncover Australia's next high-growth suburbs.

Frequently Asked Questions

Is new infrastructure like an airport or train station always a good sign for investors?

Not necessarily. While infrastructure can stimulate jobs and improve access, it can also introduce negative factors like increased noise, traffic, and disruption. Its impact on property values is not always positive, so it shouldn't be the sole reason for an investment decision.

Should I avoid suburbs with higher crime rates or a lot of public housing?

These factors can be concerning, but they are often already reflected in the property prices. Data shows that such characteristics do not always prevent strong capital growth, especially when other key demand and supply metrics are positive. An investor's focus should remain on the data that drives returns.

Is it better to buy a great house in an average suburb or an average house in a great suburb?

For investment purposes, it is almost always better to buy an average or even compromised property in a suburb with outstanding growth potential. A rising tide in a top-performing suburb will lift the value of most properties within it, whereas a great house in a stagnant market is unlikely to see significant growth.