Navigating Australia's Two-Speed Property Market in 2024

How to use data analytics to identify investment opportunities as major city markets cool down.

The Shifting Tides of Australian Real Estate

Recent headlines point towards a housing boom that is losing steam, but the reality is far more nuanced. Australia is currently experiencing a 'two-speed' property market, where different cities and regions are moving at vastly different paces. While indicators show a deceleration in major hubs like Sydney and Melbourne, this shift doesn't signal an end to opportunity—it signals a change in strategy for savvy buyers and investors.

What is a 'Two-Speed' Property Market?

A two-speed market is characterized by divergent performance across the country. We're seeing clear evidence of this as leading property value indices show slowing growth momentum, particularly in Australia's two largest cities. This is further reflected in the auction market, where final clearance rates in Sydney and Melbourne have fallen from their recent peaks. This cooling at the top end creates a complex environment, but also highlights potential in other markets that may be following a different growth trajectory. Understanding these underlying trends is crucial, and that's where powerful real estate analytics become indispensable.

Key Metrics That Reveal Hidden Opportunities

To navigate this landscape successfully, you need to look beyond the headlines and focus on the data that matters. Key performance indicators (KPIs) provide a clear, objective view of a market's health and potential.

Dwelling Value Indices: Tracking the daily or monthly change in property values provides the most immediate sense of market momentum.

Auction Clearance Rates: This is a strong indicator of buyer sentiment. A sustained drop suggests that supply is beginning to outstrip immediate demand, giving buyers more negotiating power.

Days on Market (DOM): An increase in the average time a property takes to sell can indicate a shift from a seller's to a buyer's market.

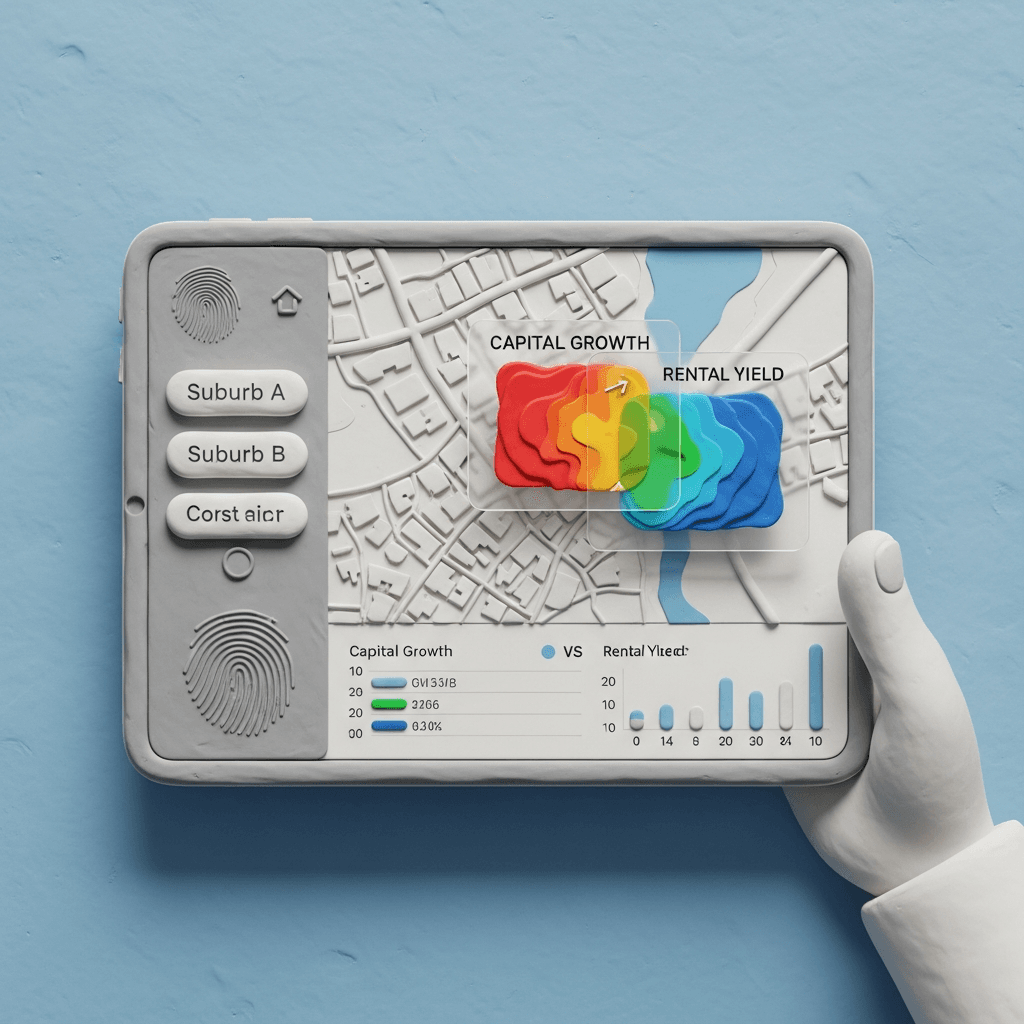

Suburb-Level Analytics: City-wide data can be misleading. Granular analysis of specific suburbs can uncover pockets of growth and value that are missed by broader market summaries.

Using Technology to Gain a Competitive Edge

In a complex market, the right tools can be the difference between a great investment and a costly mistake. Instead of relying on guesswork, data-driven platforms can help you pinpoint the best opportunities with precision. By leveraging a platform with deep market analytics, you can compare suburbs, track growth trends, and identify locations that meet your specific financial goals. Furthermore, an AI Property Search allows you to search using natural language for criteria like "suburbs with high rental yield and good school zones," cutting through the noise to find what truly matters to you. For a more guided experience, an AI Buyer's Agent can provide personalised recommendations based on a holistic view of the market and your unique profile.

Conclusion

The Australian property market's transition to a two-speed environment presents both challenges and significant opportunities. The key to success is moving past broad generalisations and embracing a data-driven approach. By focusing on key metrics and leveraging advanced technology, you can identify high-growth areas and make informed decisions, regardless of national trends. Tools designed for deep analysis are no longer a luxury but a necessity for any serious property buyer.

Ready to uncover the opportunities in today's property market? Explore our powerful suite of Real Estate Analytics to make your next move with confidence.

Frequently Asked Questions

What does a 'two-speed' housing market mean?

A two-speed, or multi-speed, housing market refers to a situation where property values and market conditions are performing differently across various geographical areas. For example, major capital cities like Sydney and Melbourne might be experiencing a slowdown in growth, while other cities or regional areas could still be growing strongly.

Which data points are most important for property investors?

While many metrics are useful, key indicators for investors include capital growth trends, rental yields, vacancy rates, auction clearance rates, and days on market. Analyzing these at a suburb level, rather than just a city level, provides a much more accurate picture for investment decisions.

How can technology help me find a good investment property?

Technology, especially AI-powered platforms, can process vast amounts of market data to identify trends and opportunities that would be impossible to find manually. You can use an AI search tool to filter properties based on complex lifestyle and investment criteria, and use analytics platforms to compare suburb performance, forecast growth potential, and mitigate risk.