Negative Gearing in Australia: A Complete Guide to Proposed Tax Changes

An in-depth analysis of proposed limits on property tax breaks and the potential impact on Australian investors.

Introduction

Navigating the Australian property market in mid-2025 means staying ahead of constant conversations around policy and affordability. Among the most debated topics are negative gearing and the Capital Gains Tax (CGT) discount—two pillars of property investment strategy that face potential reform. For both seasoned investors and aspiring homeowners, understanding these proposed changes is not just academic; it's crucial for making informed financial decisions.

This guide cuts through the political noise to provide a clear, data-driven analysis. We'll break down how negative gearing works, detail the proposed reforms, examine who is most affected, and explore the potential ripple effects on housing supply, property prices, and the broader market. Our goal is to equip you with the knowledge to navigate this complex landscape with confidence.

Understanding the Current Tax Framework for Investors

Before dissecting potential changes, it's essential to grasp the two key mechanisms at the heart of the debate: negative gearing and the Capital Gains Tax discount. These policies significantly influence the financial outcomes of property investment in Australia.

What is Negative Gearing?

A property is 'negatively geared' when the rental income it generates is less than the total expenses required to hold it, including mortgage interest, council rates, maintenance, and management fees. Under current Australian tax law, investors can deduct this net rental loss from their other taxable income (such as their salary). This reduces their overall taxable income, often resulting in a tax refund.

Example:

An investor earns a salary of $120,000.

Their investment property generates $25,000 in rent but incurs $35,000 in deductible expenses.

The net loss is $10,000.

The investor's taxable income is reduced from $120,000 to $110,000.

The opposite of this is 'positive gearing,' where the rental income exceeds expenses. In this scenario, the net profit is added to the investor's taxable income, increasing their tax liability.

The Capital Gains Tax (CGT) Discount

Capital Gains Tax is levied on the profit made from selling an asset, such as an investment property. To encourage long-term investment, the Australian tax system offers a significant incentive. If an investor holds a property for more than 12 months, they are eligible for a 50% discount on the capital gain.

Example:

An investor sells a property and makes a capital gain of $100,000.

Because they held it for over 12 months, the 50% discount applies, reducing the taxable gain to $50,000.

This $50,000 is then added to their taxable income for that year and taxed at their marginal rate.

Together, negative gearing provides short-term cash flow support via tax deductions, while the CGT discount rewards long-term capital growth. This framework has historically made property an attractive asset class, particularly for higher-income earners who benefit most from the tax deductions.

The Proposed Changes: Limiting Tax Concessions

A recent proposal from the Australian Council of Trade Unions (ACTU) aims to reform this system to address housing affordability and perceived tax inequality. The core idea is to limit these powerful tax concessions.

Key Elements of the Proposal

Limit on Properties: The ability to claim negative gearing and the 50% CGT discount would be restricted to a single investment property per investor.

Grandfathering Period: The changes would not be immediate. A proposed five-year transition period would allow existing investors with multiple properties time to adjust their portfolios before the new rules take effect.

This proposal is designed to be less disruptive than previous reform attempts, as it would leave the majority of property investors—those with only one investment property—unaffected. The stated goal is to level the playing field for first-home buyers and generate tax revenue that could be redirected into social and affordable housing initiatives.

Data Deep Dive: Who Do These Changes Really Affect?

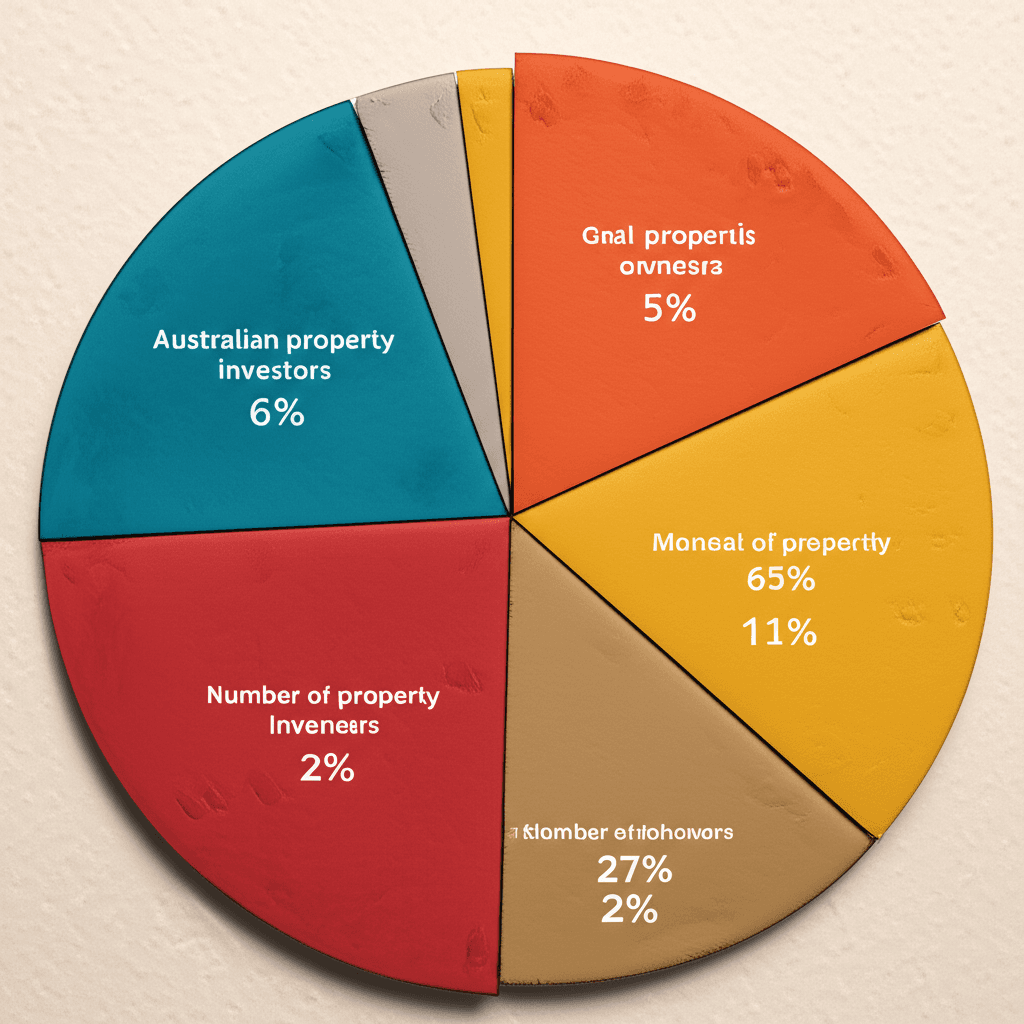

To understand the potential impact, we must analyze who currently utilizes these tax provisions. According to a detailed analysis of ATO statistics for the 2022-23 financial year, the landscape of Australian property investment is more nuanced than often portrayed.

Total Property Investors: Just over 2.2 million Australians own at least one investment property.

Negatively Geared Investors: Of those, approximately 1.1 million (50%) reported a net rental loss.

Single Property Owners: A significant majority of negatively geared investors—around 810,000 (74%)—own only one investment property. These individuals would be entirely unaffected by the proposed changes.

Multiple Property Owners: This leaves approximately 306,000 investors (about 13% of all investors) who are negatively geared on two or more properties. This is the specific group the reform targets.

While 306,000 people represent just over 1% of the Australian population, this group holds a substantial portfolio of properties and claims a significant portion of the tax deductions. The Parliamentary Budget Office has previously reported that the benefits of negative gearing and CGT discounts are disproportionately skewed towards the highest income earners.

Potential Market Impacts: The Unintended Consequences

While the proposal targets a specific investor segment, any change to tax policy can have far-reaching and sometimes unintended consequences for the entire property market. A critical part of investment strategy involves using sophisticated real estate analytics to model these potential shifts.

1. Reduced Housing Supply and Market Activity

A primary concern is that altering the CGT discount could create a 'lock-in' effect. If investors with multiple properties face a much larger tax bill upon selling, they may choose to hold onto their assets indefinitely rather than realize the gain. This could lead to:

Fewer Listings: A reduction in the number of established properties for sale would tighten supply, potentially driving up prices for the limited stock available.

Decreased Government Revenue: While the reform aims to raise income tax revenue, a slowdown in property transactions would significantly reduce collections from stamp duty—a major source of state government revenue.

2. Pressure on the Rental Market

Investors provide the vast majority of rental housing in Australia. If the incentive to purchase and hold investment properties is diminished, it could slow the delivery of new rental stock to the market. With population growth continuing to outpace housing construction, as tracked by the Australian Bureau of Statistics (ABS), any further constraint on rental supply could exacerbate the existing rental crisis, leading to lower vacancy rates and higher rents.

3. A Shift in Investor Strategy

Faced with these changes, sophisticated investors would adapt. Strategies might shift towards:

Cash Flow Positive Properties: A greater focus on properties that generate positive or neutral cash flow from day one, reducing reliance on tax deductions.

Development and Value-Add: Investors may seek properties with development potential to manufacture equity, rather than relying solely on passive capital growth.

Alternative Ownership Structures: An increase in the use of trusts or other structures to manage property portfolios, adding complexity to the market.

Conclusion: A Complex Problem with No Easy Answers

The debate over negative gearing is a clash of competing priorities: tax fairness and housing affordability versus market stability and rental supply. The ACTU's proposal offers a targeted approach that shields the majority of single-property investors. However, the data suggests that while only a small cohort of investors would be directly affected, the potential knock-on effects on market liquidity and rental availability cannot be ignored.

Ultimately, tackling housing affordability requires a multi-faceted approach that goes beyond tax reform to address the core issue: a structural undersupply of housing. For investors, this period of uncertainty underscores the importance of a data-driven strategy. Understanding market fundamentals, cash flow dynamics, and long-term growth drivers is more critical than ever.

Ready to make smarter investment decisions with powerful insights? Explore our real estate analytics platform to stay ahead of market changes and build a resilient property portfolio.

Frequently Asked Questions

What is negative gearing in simple terms?

Negative gearing is when your expenses for an investment property (like loan interest, council rates, and maintenance) are more than the rental income you receive. In Australia, you can deduct this financial loss from your taxable income, which can lower the amount of tax you have to pay.

Who benefits most from the current negative gearing rules?

Currently, high-income earners tend to benefit the most from negative gearing. Because they are in a higher tax bracket, the value of the tax deduction is greater. They also typically have more capacity to purchase investment properties that may initially run at a loss.

How can I find properties with better cash flow potential?

Finding properties with strong rental yields and the potential to become positively geared requires deep market analysis. Tools like the HouseSeeker AI Property Search allow you to filter for specific criteria like rental yield and proximity to transport and amenities, while our AI Buyer's Agent can provide personalised recommendations based on your financial goals.