The Office-to-Apartment Dream: A Data-Driven Reality Check on Australia's Housing Crisis

An in-depth look at the structural and economic barriers hindering office conversions and the real data behind Australia's housing shortage.

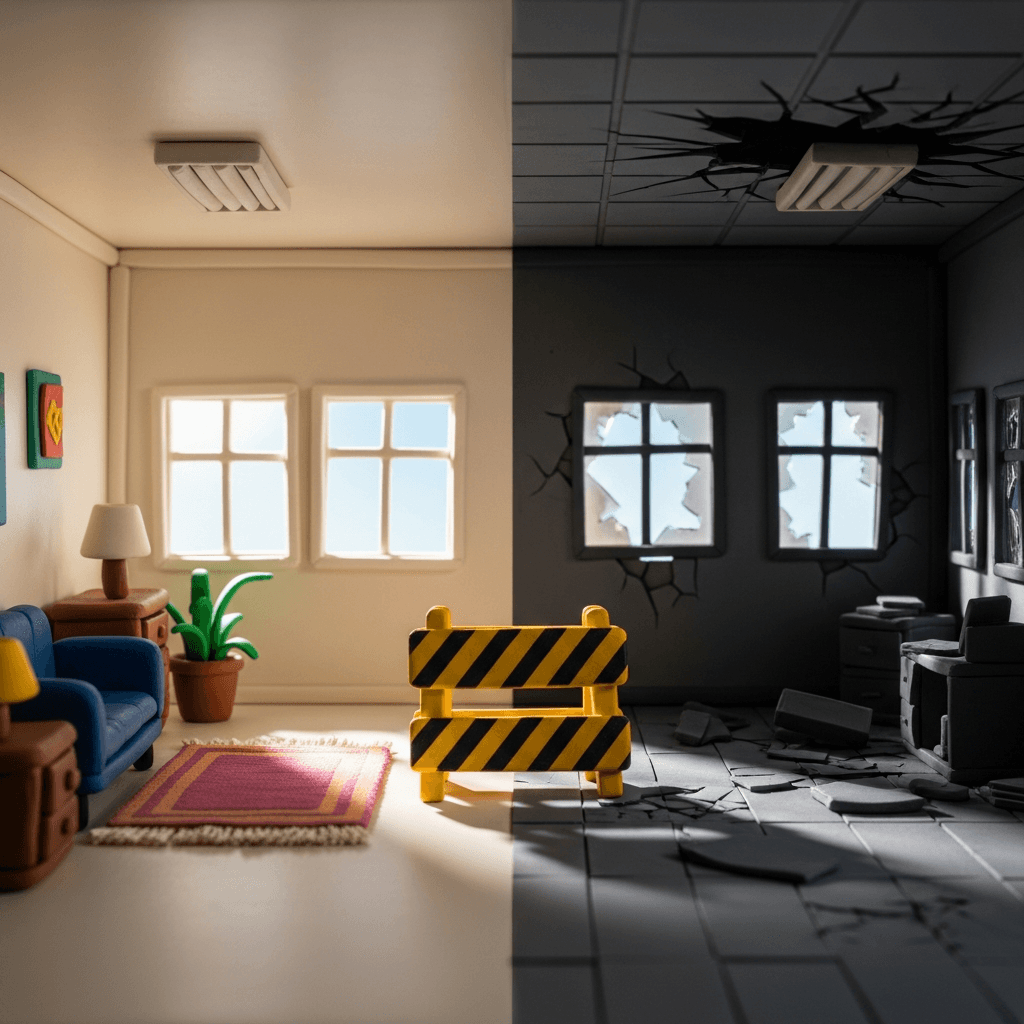

The Promise vs. The Reality

As Australian cities grapple with a severe housing crisis and rising office vacancies, the idea of converting empty office buildings into residential apartments seems like an elegant solution. However, despite government promises and market need, this seemingly straightforward fix has failed to gain traction, revealing a more complex story about our property market.

Why The Momentum Has Stalled

The data paints a clear picture of inaction. In central Melbourne, developers have not submitted a single application for an office-to-residential conversion since 2023. Meanwhile, in Sydney, the nation's most unaffordable city, only one successful application has been made. Landlords, facing staggering refitting costs, are opting to wait out the market, hoping for either a return of workers or significant government subsidies to make conversions viable. This hesitation highlights a fundamental disconnect between a proposed solution and its practical execution.

The Structural and Financial Hurdles

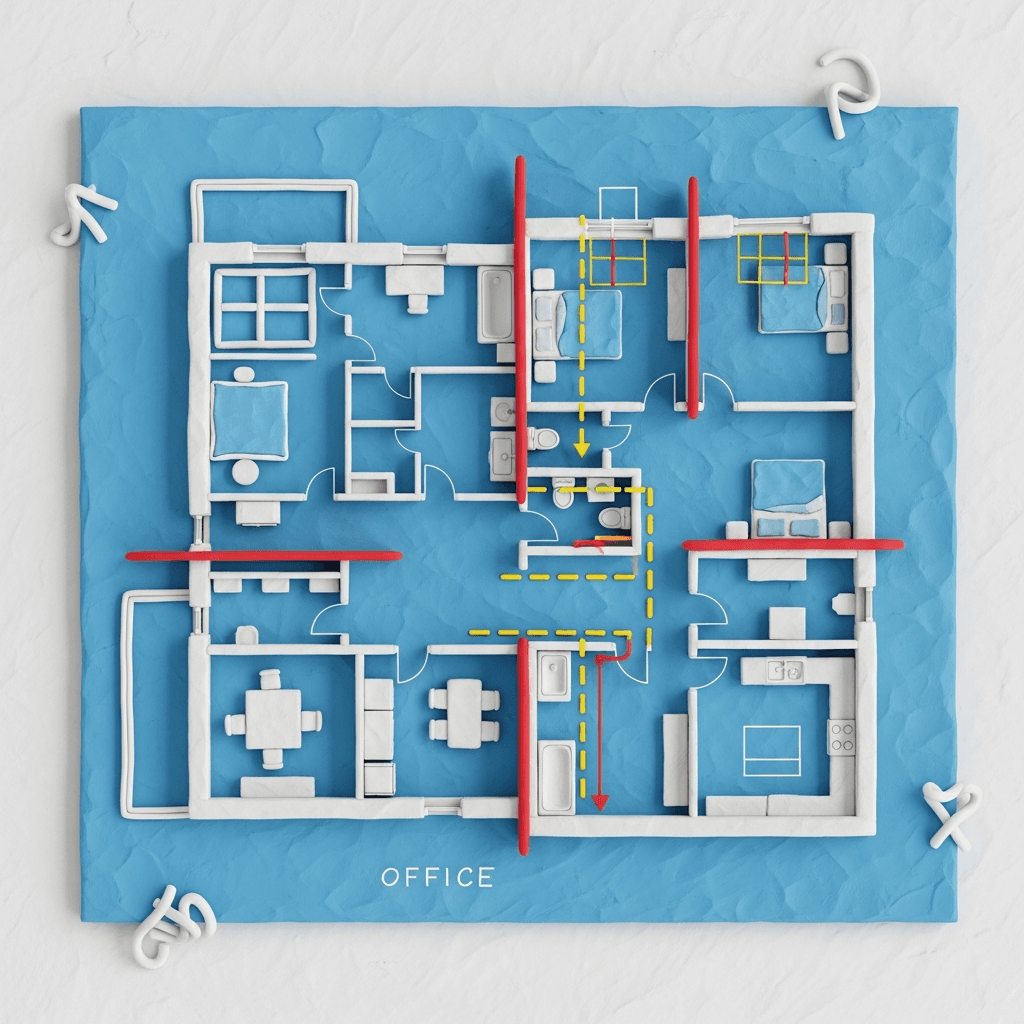

Not all office towers are created equal, and very few are suitable for residential living. Professor Philip Oldfield of UNSW notes that the size and shape of office floor plans are primary impediments. The deep floor plates common in office buildings create apartments with poor natural light and ventilation. As Professor Oldfield estimated, out of 50 empty buildings in Sydney's CBD, perhaps only five to ten would be architecturally suitable for conversion. Beyond the structural challenges, the costs of retrofitting—including plumbing, electrical, and facade alterations—are often prohibitively expensive.

Uncovering the Real Problem: Chronic Undersupply

Focusing on conversions distracts from the core issue plaguing the Australian housing market: a chronic and accumulating supply deficit. According to AMP chief economist Shane Oliver, this undersupply has been building since the mid-2000s, when population growth began to significantly outpace the construction of new homes. His analysis estimates the current housing shortfall to be between 200,000 and 300,000 dwellings. This fundamental imbalance between demand and supply is the primary driver of rising property prices. This forecast is further supported by the federal government’s National Housing Supply and Affordability Council (NHSAC), which projects the nation's housing shortage will worsen by another 79,000 homes over the next five years.

Conclusion: Look Beyond the Gimmicks

While converting offices into apartments is an appealing concept, the evidence shows it is a policy gimmick that fails to address the root cause of Australia's housing affordability crisis. The significant structural, financial, and logistical barriers make it an unscalable solution. True progress lies in addressing the long-standing housing supply deficit through comprehensive, data-informed strategies. For prospective buyers and investors, it's crucial to understand these deeper market dynamics to make informed decisions, rather than being swayed by superficial solutions.

To cut through the noise and base your property decisions on robust data, explore the HouseSeeker Real Estate Analytics Hub and gain a true understanding of the market.

Frequently Asked Questions

Why are office-to-apartment conversions so difficult in Australia?

Conversions face major hurdles, including prohibitively high retrofitting costs and fundamental structural issues. Many office buildings have deep floor plans unsuitable for residential living, leading to challenges with natural light, ventilation, and plumbing, making them financially and practically unviable.

What is the main cause of Australia's housing shortage?

Economists and housing councils point to a chronic, long-term undersupply of housing. For nearly two decades, the construction of new homes has not kept pace with the country's population growth, resulting in an estimated current deficit of 200,000 to 300,000 dwellings.

How can data analytics help navigate the current property market?

In a complex market filled with ineffective 'solutions', data analytics provides clarity. By using tools to analyze supply-demand dynamics, historical price trends, and suburb-specific growth indicators, buyers can identify genuine opportunities and make investment decisions based on evidence, not headlines. Understanding the data is key to a successful property journey.