40-Year Mortgages in Australia: A Guide to Longer Loan Terms

Discover how extending your mortgage term impacts repayments, borrowing power, and your overall property strategy in a changing market.

The New Frontier of Australian Home Loans

Navigating the Australian property market has become increasingly challenging, with affordability being a major hurdle for many aspiring homeowners and investors. In response, a new financial product is gaining traction: the 40-year mortgage. While common in countries like Japan and the UK, these extended loan terms are a relatively new concept in Australia, promising lower monthly repayments but raising questions about long-term costs. Is this the key to unlocking the property market, or a potential debt trap? This guide breaks down the numbers, pros, and cons to help you make an informed decision.

The Core Trade-Off: Lower Repayments vs. Higher Interest

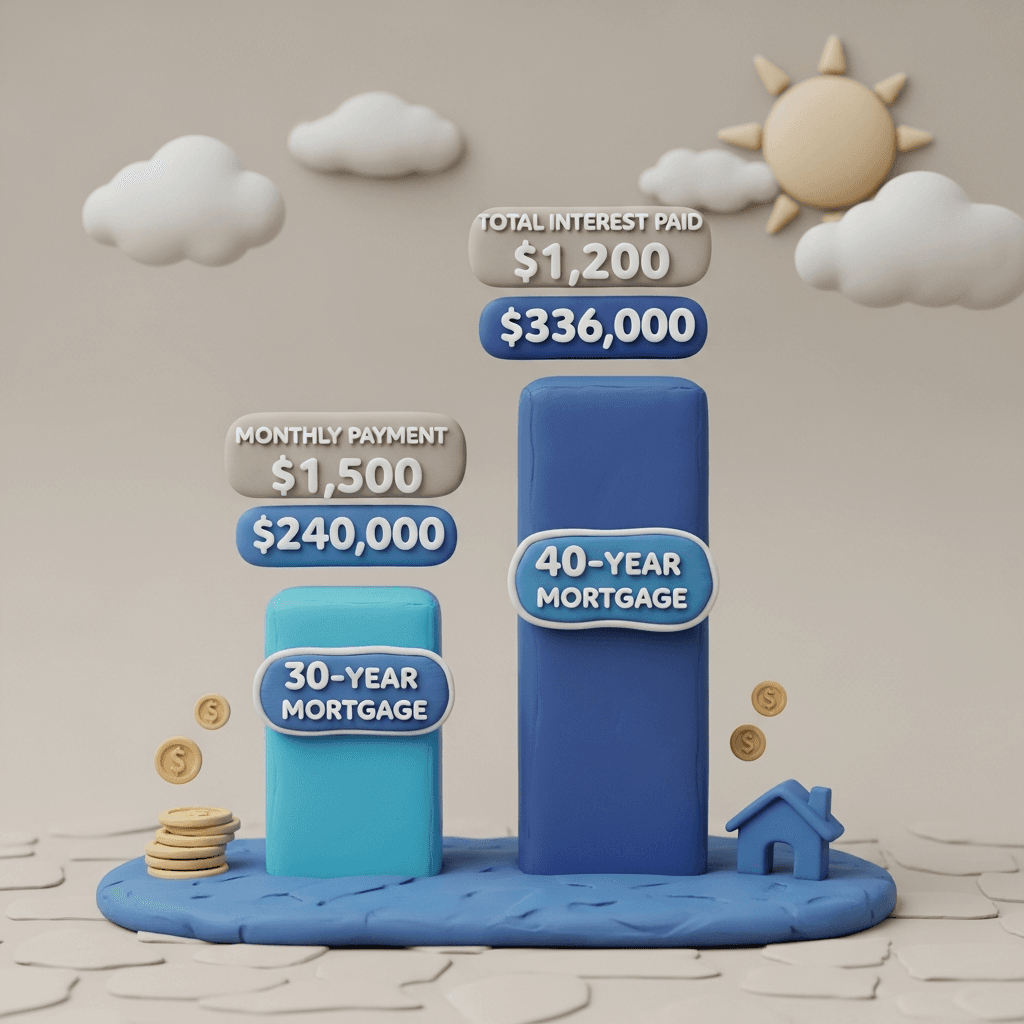

The fundamental appeal of a 40-year mortgage is spreading the loan principal over an additional decade, which reduces the size of each monthly repayment. However, this convenience comes at a significant cost: you'll pay substantially more in interest over the life of the loan. It's a classic case of short-term relief versus long-term expense.

Let's analyse a typical scenario for a $750,000 property purchase with a 20% deposit, resulting in a $600,000 loan:

| Metric | 30-Year Mortgage | 40-Year Mortgage | The Difference | | :--- | :--- | :--- | :--- | | Monthly Repayment | $3,422 | $3,152 | $270 less per month | | Total Interest Paid | $631,851 | $893,265 | $261,414 more in interest |

As the numbers show, while you save $270 per month in cash flow, the long-term interest cost is over a quarter of a million dollars higher if you see the loan through to the end.

The Upside: Why a 40-Year Loan Might Be a Smart Move

Despite the daunting interest figures, a 40-year mortgage can be a powerful strategic tool in specific situations.

Increased Borrowing Capacity: For many buyers, serviceability is the biggest barrier. Extending the loan term can increase your borrowing capacity. For a family with a combined income of $180,000, a 40-year term could boost borrowing power by approximately $30,000. While not a massive leap, it can be the critical difference needed to secure a property in a competitive market. This extra capacity could be equivalent to what you'd gain from a 0.5% interest rate drop.

Improved Monthly Cash Flow: The saving of a few hundred dollars a month might seem small, but it can be the make-or-break factor for meeting a lender's serviceability criteria or simply managing household finances more comfortably. This extra buffer can provide essential breathing room for first-home buyers.

Bridging the Rent-vs-Buy Gap: In many suburbs, renting is becoming almost as expensive as owning. For a $750,000 property with a 4.5% rental yield, the monthly rent would be around $2,813. With a 40-year mortgage, the repayment is $3,152—a difference of only $340 per month. This makes the leap from renting to owning far more achievable, allowing you to build equity instead of paying someone else's mortgage. Finding these kinds of opportunities is simpler with powerful tools that enable lifestyle-based filtering.

The Essential Rule: This Is Not a 'Set and Forget' Strategy

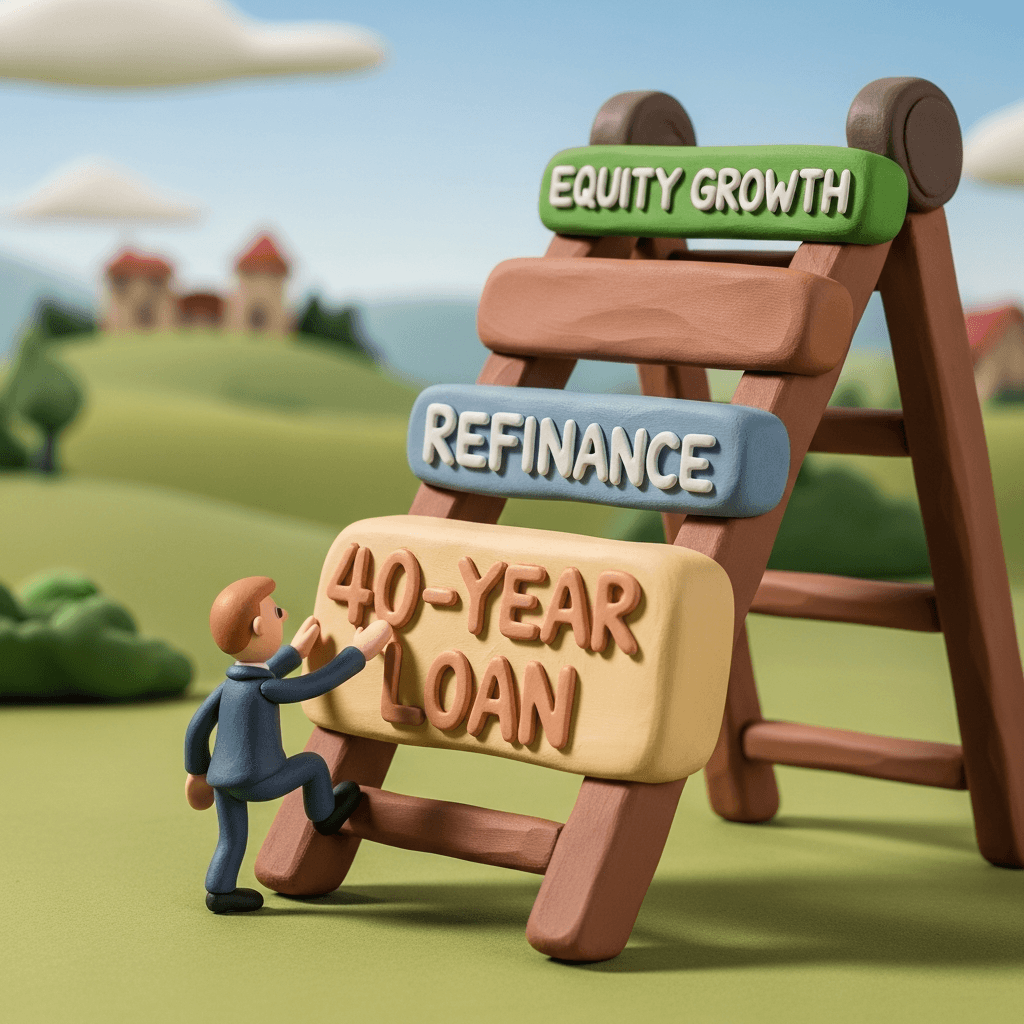

The single most important takeaway is that a 40-year mortgage should never be a long-term plan. The average home loan in Australia is held for only three to seven years before the owner refinances, sells, or extracts equity. This product is best viewed as a temporary stepping stone, not a 40-year commitment.

The strategy is to use the 40-year term to get your foot in the door of a rising market. Once you've built some equity through capital growth or by making extra repayments, the goal is to refinance to a standard 30-year loan with a more competitive interest rate. This approach allows you to secure an asset without committing to the massive long-term interest costs.

Who Is Offering 40-Year Mortgages?

While the major banks are still cautious, several lenders are pioneering these products in Australia. Currently, you can find 40-year (or 35-year) loan terms from lenders such as:

Pepper Money

Great Southern Bank (GSB)

Credit Union SA

Youbank

Interestingly, Westpac is reportedly trialing these loans unofficially within its private banking division, suggesting that longer terms may become more mainstream in the future.

The Strategic Playbook for Buyers and Investors

This isn't a one-size-fits-all solution. Its effectiveness depends entirely on your financial strategy and exit plan. The goal is to leverage the short-term benefits to achieve a long-term advantage.

An effective plan involves using the loan to acquire the asset, allowing the property's value to appreciate for a few years, and then refinancing to a more conventional loan structure. This requires careful planning and a deep understanding of market dynamics. A guided buying process can be invaluable in ensuring your financing aligns with your property goals.

Conclusion: A Tool, Not a Crutch

A 40-year mortgage is a specialised financial instrument designed to address the immediate challenges of housing affordability and borrowing capacity. It can be an effective way to enter the property market sooner, but it comes with the significant drawback of higher long-term interest costs. It should only be considered as part of a well-defined strategy that includes a clear plan to refinance within a few years. Like any powerful tool, its value lies in how you use it.

Ready to make a data-driven property decision? Explore market trends, analyse suburb performance, and understand the numbers behind your next purchase with HouseSeeker's Real Estate Analytics Hub.

Frequently Asked Questions

How much can I save monthly with a 40-year mortgage?

On a typical $600,000 loan, a 40-year mortgage could reduce your monthly repayments by approximately $270 compared to a standard 30-year loan. This saving helps with cash flow and serviceability assessments.

Do 40-year mortgages significantly increase borrowing power?

They provide a modest increase. For a family earning a combined $180,000, it might add around $30,000 to their borrowing capacity. While not a game-changer for everyone, this can be the crucial difference needed to win at auction or secure a desired property.

Can I combine a 40-year loan with the government's 5% deposit scheme?

Currently, no. The First Home Guarantee scheme rules cap the loan term at 30 years. While this could change in the future, the two products cannot be paired at this time.