Australia's 2026 Property Market: An Investor's Guide to Navigating New Risks

With lending rules tightening and speculative bubbles forming, understanding the latest market shifts is crucial for protecting your portfolio in the year ahead.

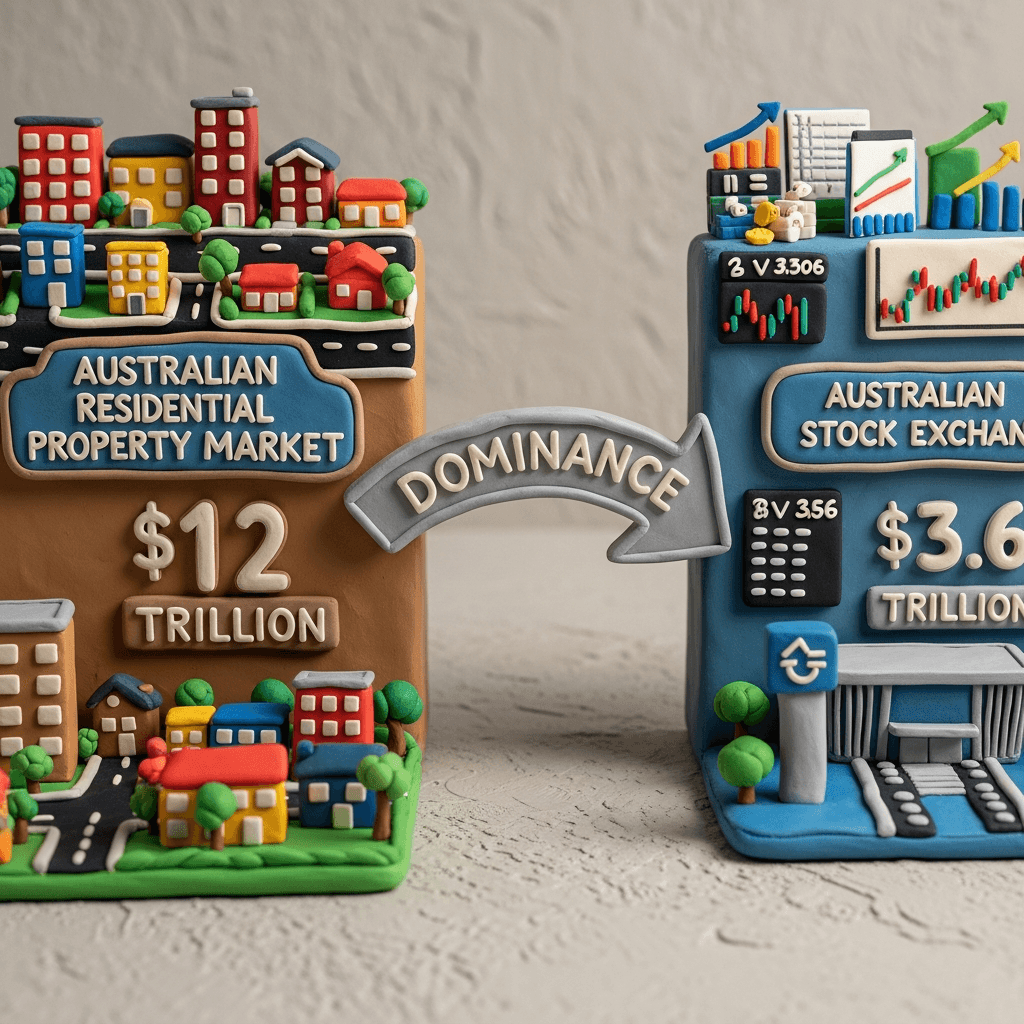

The Australian Property Market: A $12 Trillion Behemoth

Navigating the Australian property market requires a clear understanding of its sheer scale. The residential real estate market is valued at a staggering $12 trillion, dwarfing the entire Australian stock exchange's $3.6 trillion valuation. With approximately 55% of Australian household wealth tied up in housing, it's clear that for most, property is the primary vehicle for wealth creation. However, this heavy concentration also presents significant risks, especially as market dynamics shift heading into 2026.

The First Home Buyer Scheme: Fuel on the Fire?

Recent government initiatives, like the increased cap for the First Home Owner Grant scheme, were designed to improve housing affordability. In reality, they have ignited fierce competition at the entry-level of the market. Cities like Perth, Brisbane, and Adelaide have seen price surges of 3-4% in just two months at a macro level, with double-digit growth being observed in specific sub-markets targeted by the scheme. This has pushed prices up so aggressively that many potential buyers are being priced out, while those who succeed are buying into a potentially inflated market. The primary beneficiaries are often developers and vendors, not the first-time buyers the scheme was intended to help.

APRA's Crackdown: A Response to Surging Investor Debt

The market is also witnessing a massive surge in investor activity, with new investment loans accounting for 40% of all new lending—the highest share since 2017. This has prompted regulators like the Australian Prudential Regulation Authority (APRA) to intervene. We're now seeing major lenders like Macquarie and CBA pull back from complex lending structures, such as trust and company loans, which were often used by portfolio investors to expand their borrowing capacity. This regulatory tightening is a direct response to growing concerns about households taking on excessive debt to acquire speculative assets, and it signals a move towards a more controlled lending environment.

Warning Signs: The Danger of Speculative Bubbles and 'Spruikers'

The current market frenzy has created a fertile ground for property 'spruikers' and advisory 'chop shops' promoting high-risk, speculative assets. These groups often push investors towards regional areas or house-and-land packages with the promise of high rental yields. However, these assets often lack owner-occupier appeal and are located in areas with an oversupply of land and limited infrastructure. A frightening example is an estate in Two Rocks, Western Australia, where one firm reportedly sold 70% of the properties to investors. When these projects are completed, the market will be flooded with rental properties, causing vacancy rates to soar and values to plummet. This is a recipe for disaster, leaving inexperienced investors dangerously overexposed.

To avoid these traps, investors need to prioritise due diligence and independent analysis. Leveraging sophisticated tools like an AI-powered property search can help identify assets with strong fundamentals, while a dedicated service like an AI Buyer's Agent can provide personalised, data-driven guidance.

Navigating an Uncertain Future

Adding to the complexity are APRA's new debt-to-income limits and the volatile outlook for interest rates. Just weeks after major banks predicted rate cuts for 2026, the narrative has flipped to a discussion of potential rate hikes. This uncertainty underscores a critical point: macroeconomic predictions are often unreliable. Rather than chasing trends or acting on fear of missing out, the most prudent strategy is to focus on quality, data-backed asset selection. A thorough analysis of market trends, suburb performance, and asset fundamentals is no longer optional—it's essential for survival and success. Explore how our Real Estate Analytics platform can provide the clarity you need.

Conclusion

The Australian property market in 2026 presents a landscape of both opportunity and significant risk. While growth is forecast for the early part of the year, regulatory tightening and the prevalence of speculative advice demand extreme caution. Investors who succeed will be those who ignore the hype, focus on high-quality assets with strong owner-occupier appeal, and base their decisions on rigorous, independent data analysis.

Ready to cut through the noise? Leverage HouseSeeker's advanced real estate analytics to make informed, data-backed investment decisions for 2026.

Frequently Asked Questions

What are the biggest risks for property investors in 2026?

The primary risks include buying into artificially inflated markets fueled by government grants, the impact of APRA's lending crackdown reducing credit availability, and falling victim to 'spruikers' who push speculative assets in oversupplied areas. Interest rate uncertainty also adds a layer of financial risk.

How is APRA's crackdown on trust lending affecting investors?

It primarily impacts portfolio investors who used trust structures to increase their borrowing capacity. By restricting this type of lending, APRA aims to curb the accumulation of excessive debt. This will make it more difficult for highly leveraged investors to continue buying, potentially cooling demand in certain market segments.

Are house-and-land packages a safe investment?

They can be extremely risky, especially when purchased in new estates far from established infrastructure and with an abundance of future land supply. These areas are often targeted by investment firms and can become oversaturated with rental properties, leading to high vacancy rates and poor capital growth once the building is complete.