Australia's Next Property Supercycle: How Rate Cuts Could Fuel a Market Boom

An in-depth analysis of the economic factors—from interest rate cuts to supply shortages—poised to drive significant growth in Australian real estate.

Understanding the Coming Shift in Australian Real Estate

The Australian property market is poised for a significant transformation, with many analysts forecasting an impending 'supercycle' of price growth. This shift isn't based on speculation alone, but on a convergence of powerful economic factors, including anticipated interest rate cuts, persistent inflation, a national supply crisis, and global liquidity trends. Understanding these drivers is crucial for homebuyers and investors looking to navigate the dynamic landscape over the next 12 to 24 months.

The Primary Catalyst: Interest Rate Cuts and Borrowing Power

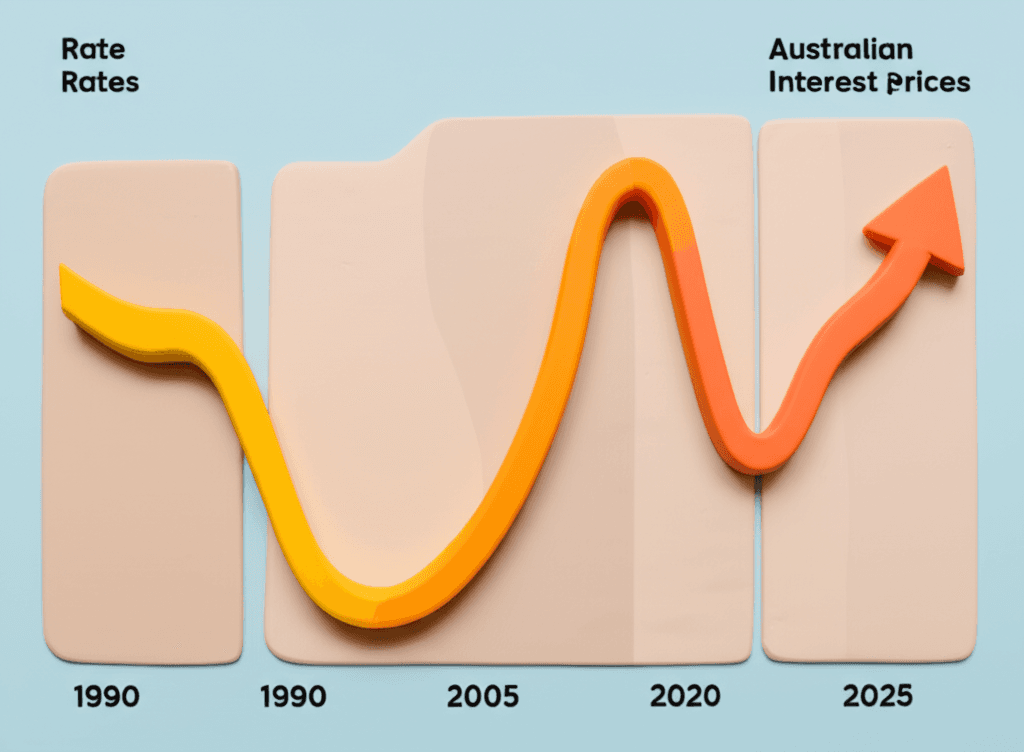

Historically, there has been a strong inverse relationship between interest rates and property prices in Australia. When the Reserve Bank of Australia (RBA) cuts the cash rate, borrowing becomes cheaper, which in turn significantly increases the borrowing capacity for potential buyers. Lenders like the National Australia Bank (NAB) have forecast potential rate cuts exceeding 150 basis points, which would dramatically boost how much buyers can afford.

This increased borrowing power fuels demand. A property that seems just out of reach today could become attainable for a larger pool of buyers tomorrow, intensifying competition and driving prices upward. For investors and homebuyers with pre-approval, this means that waiting could result in being priced out of their desired markets as values escalate. Historical data consistently shows that periods of rate cuts, such as post-GFC and during the 2020 pandemic, have preceded some of the most substantial bull runs in Australian property history.

A Perfect Storm: Severe Supply Shortage Meets Soaring Demand

Beyond cheaper credit, the market is constrained by a fundamental imbalance between supply and demand. Australia is facing a critical housing supply crisis that shows no signs of abating. Over the past decade, the number of available properties for sale or rent has fallen by over 35%, while the population has grown by more than 12%.

New construction is hampered by rising costs and a wave of insolvencies in the building sector, muting the pipeline of future housing stock. Simultaneously, demand is being supercharged. A tight rental market, with vacancy rates consistently below 1%, is forcing many tenants to consider buying. Furthermore, significant immigration adds pressure, as newcomers typically rent before purchasing, further squeezing the rental market and eventually adding to buyer demand. This structural deficit of homes ensures that competition for existing properties will remain intense.

Macroeconomic Tailwinds: Historical Cycles and Global Money Supply

Broader economic theories also support the supercycle hypothesis. The 18.6-year land cycle, a theory based on over a century of data, suggests the market is entering the 'winner's curse' phase—the most explosive period of growth in the cycle. This phase is characterized by rapid price appreciation as all the underlying economic factors align.

Furthermore, global financial conditions play a crucial role. The global M2 money supply, a measure of liquidity in the financial system, is beginning to tick higher. An increase in money supply often leads to asset inflation, as more capital chases a finite number of assets like real estate. This phenomenon is driven by currency debasement, where the purchasing power of money decreases over time due to inflation. To protect their wealth from this erosion, investors flock to hard assets like property, further fuelling price growth.

Navigating the Market with a Data-Driven Strategy

In a rapidly accelerating market, a reactive approach is a recipe for failure. The days of casually researching a few neighbouring suburbs over several months are gone. In a supercycle, hesitation can cost hundreds of thousands of dollars in capital growth or, worse, price you out of the market entirely. This is why adopting a 'borderless' investment strategy, informed by comprehensive data, is essential. By analysing markets across Australia, you can pivot to areas that still offer value and growth potential.

Leveraging advanced tools is no longer an advantage; it's a necessity. Platforms that use artificial intelligence can help you move faster and with more confidence. Whether you are searching for a home based on specific lifestyle needs with an AI-powered property search or seeking guided, data-backed recommendations through an AI Buyer's Agent, technology empowers you to make smarter decisions.

Conclusion

The convergence of impending interest rate cuts, a chronic housing supply shortage, a tight rental market, and favourable macroeconomic cycles is creating the perfect conditions for a property supercycle in Australia. While the prospect of significant growth is exciting, it also creates a high-stakes environment where informed, swift action is paramount. Relying on robust data and a clear strategy is the only way to effectively navigate the complexities of the coming market, protect against emotional decisions like FOMO, and secure a strong position for long-term growth. Preparing now means you are positioned not just for the upswing, but also for the market dynamics that follow.

To stay ahead of the curve and make investment decisions backed by comprehensive market intelligence, explore the HouseSeeker Data Analytics Hub and unlock the insights you need to succeed.

Frequently Asked Questions

What is a property supercycle?

A property supercycle is an extended period of strong, above-average price growth in the real estate market. It's typically driven by a powerful combination of fundamental factors, such as major shifts in interest rate policy, significant supply and demand imbalances, and strong economic tailwinds, rather than just short-term market sentiment.

How do interest rate cuts increase property prices?

Interest rate cuts reduce the cost of borrowing money. This allows banks to offer lower mortgage rates, which in turn increases a potential buyer's borrowing capacity. With more people able to borrow larger amounts, overall demand for property increases, leading to more competition and higher prices.

How can I use data to find investment properties in a fast-moving market?

In a fast-moving market, data helps you identify opportunities beyond your local area. By using a platform with powerful real estate analytics, you can analyse suburb-level data on capital growth, rental yields, vacancy rates, and demographic trends across the country. This allows you to pinpoint undervalued markets with strong growth fundamentals before they become mainstream hotspots.