Australian Property Tax: A Strategic Guide for Investors

Learn how negative gearing, Capital Gains Tax concessions, and smart strategies can optimise your property investment returns.

Navigating the Australian property market in mid-2025 requires more than just a keen eye for a good location. For savvy investors, true success lies in understanding the financial engine that drives wealth creation—specifically, the tax landscape. Many see tax as a burden, but it can be one of the most powerful tools for maximising returns and accelerating portfolio growth when understood and applied correctly.

This guide demystifies the core tax concepts for Australian property investors. We'll break down rental income deductions, the much-discussed strategy of negative gearing, Capital Gains Tax (CGT), and the ultimate secret of the pros: leveraging equity without selling. By the end, you'll have a clear framework for making informed, tax-effective investment decisions.

The Two Pillars of Property Investment: Growth and Income

Before diving into tax specifics, it's essential to understand the two primary ways an investment property generates wealth. A successful investment strategy balances both.

1. Capital Growth

Capital growth is the increase in your property's value over time. The fundamental goal is for the asset's price to appreciate at a rate significantly higher than inflation or the interest earned on cash in a bank. While savings accounts might offer 3-6% interest, Australian property has historically demonstrated annual growth between 7-15% in strong market cycles. This long-term appreciation is where substantial wealth is built. Identifying suburbs with strong growth drivers—like infrastructure development, population growth, and economic diversification—is critical. This is where deep real estate analytics become indispensable, helping you move beyond speculation and into data-driven decision-making.

2. Rental Income

Rental income provides the ongoing cash flow for your investment. It's the regular payment you receive from tenants, which is used to cover the property's expenses. The relationship between this income and your expenses determines your property's 'gearing'.

Positively Geared: The rental income is greater than your expenses, resulting in a net profit and positive cash flow.

Negatively Geared: The rental income is less than your expenses, resulting in a net loss. While this sounds undesirable, it is a deliberate and powerful tax strategy, which we will explore in detail.

Mastering Your Taxable Position: Rental Income and Deductions

When you earn rental income, it is considered assessable income by the Australian Taxation Office (ATO) and must be declared on your tax return. For example, if you earn a salary of $100,000 and receive $30,000 in gross rent, your total assessable income before deductions is $130,000.

However, the magic lies in the expenses you can claim against this income. The ATO allows investors to deduct a wide range of costs associated with owning and managing a rental property. These deductions reduce your net rental income and, therefore, your overall tax liability.

Key Tax-Deductible Expenses

Most expenses directly related to the property are deductible. These include:

Loan Interest: The interest portion of your mortgage repayments is typically the largest single deduction.

Repairs and Maintenance: Costs for general upkeep to maintain the property's condition (e.g., fixing a leaky tap, repairing a broken window).

Council and Water Rates: Standard charges from local and state authorities.

Insurance: Landlord, building, and contents insurance premiums.

Property Management Fees: Fees paid to a real estate agent to manage the tenancy.

Depreciation: A crucial non-cash deduction for the decline in value of the building's structure (capital works) and the fixtures within it (plant and equipment like ovens, carpets, and air conditioners).

Depreciation is a particularly powerful tool. You have already paid for these assets when you purchased the property, but the ATO allows you to claim their decline in value as a deduction each year, significantly reducing your taxable income without affecting your cash flow.

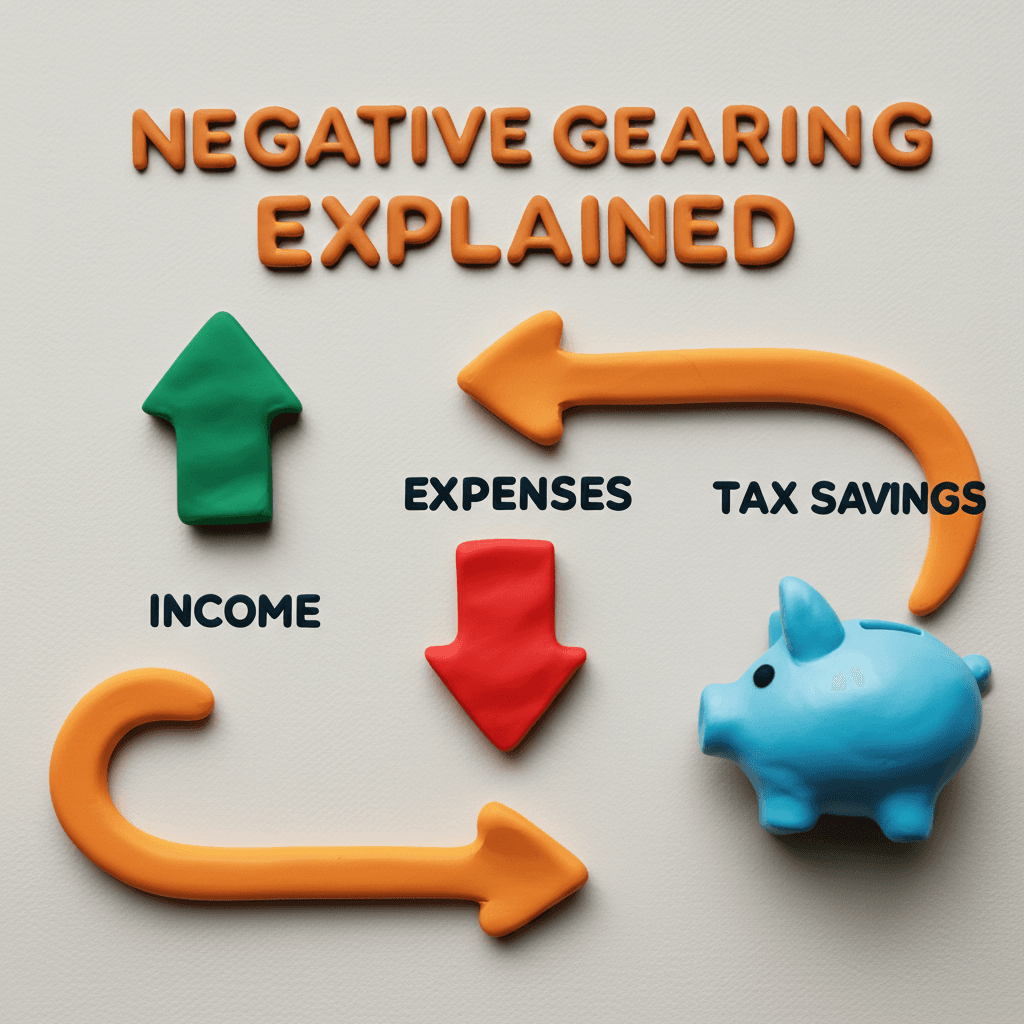

The Power of Negative Gearing Explained

Negative gearing occurs when your total deductible expenses for the property exceed the rental income it generates, creating a taxable loss. In Australia, this loss isn't quarantined; it can be used to offset your other income, such as your salary or business profits, thereby reducing your total taxable income.

Let's walk through a practical example:

1. Salary from Job: $100,000 2. Gross Rental Income: $30,000 per year 3. Total Deductible Expenses: $50,000 per year (including interest, rates, and depreciation)

In this scenario, the net rental position is a loss of $20,000 ($30,000 income - $50,000 expenses).

Instead of paying tax on your $100,000 salary, your total taxable income is reduced to $80,000 ($100,000 - $20,000).

Assuming a marginal tax rate of 30%, this $20,000 reduction results in a tax saving of $6,000. This saving effectively subsidises the property's cash flow shortfall while you wait for the asset to achieve long-term capital growth.

Navigating Capital Gains Tax (CGT) on Property

While negative gearing addresses your annual tax position, Capital Gains Tax (CGT) comes into play when you sell your investment property. CGT is not a separate tax but is applied to the 'capital gain'—the profit you make—which is then added to your assessable income for that financial year.

How to Calculate Your Capital Gain

The basic formula is straightforward:

Capital Gain = Sale Price - Cost Base

Sale Price: The amount you sold the property for.

Cost Base: This includes the original purchase price plus associated costs like stamp duty, legal fees, borrowing expenses, and the cost of any capital improvements made during ownership.

For example, if you sold a property for $1.4 million and its cost base was $1 million, your capital gain would be $400,000. This $400,000 would be added to your income and taxed at your marginal rate, which could be as high as 45%.

Key CGT Concessions for Investors

Fortunately, the Australian government offers significant concessions to reduce this tax burden.

The 12-Month Discount: If you hold an investment property for more than 12 months before selling, you are eligible for a 50% discount on the capital gain. In our example, the taxable gain of $400,000 would be halved to $200,000. Instead of paying up to $180,000 in tax, your liability would be reduced to around $90,000.

Principal Place of Residence (PPR) Exemption: If you buy a property and live in it as your main home, it is generally fully exempt from CGT when you sell it. Things become more complex if a property was your home for a period and then became a rental. In that case, you usually need a market valuation at the time it first became available to rent. The capital gain is then calculated from that valuation point, protecting the growth that occurred while it was your home. Always consult an accountant in these situations, as the rules can be complex but can save you hundreds of thousands of dollars.

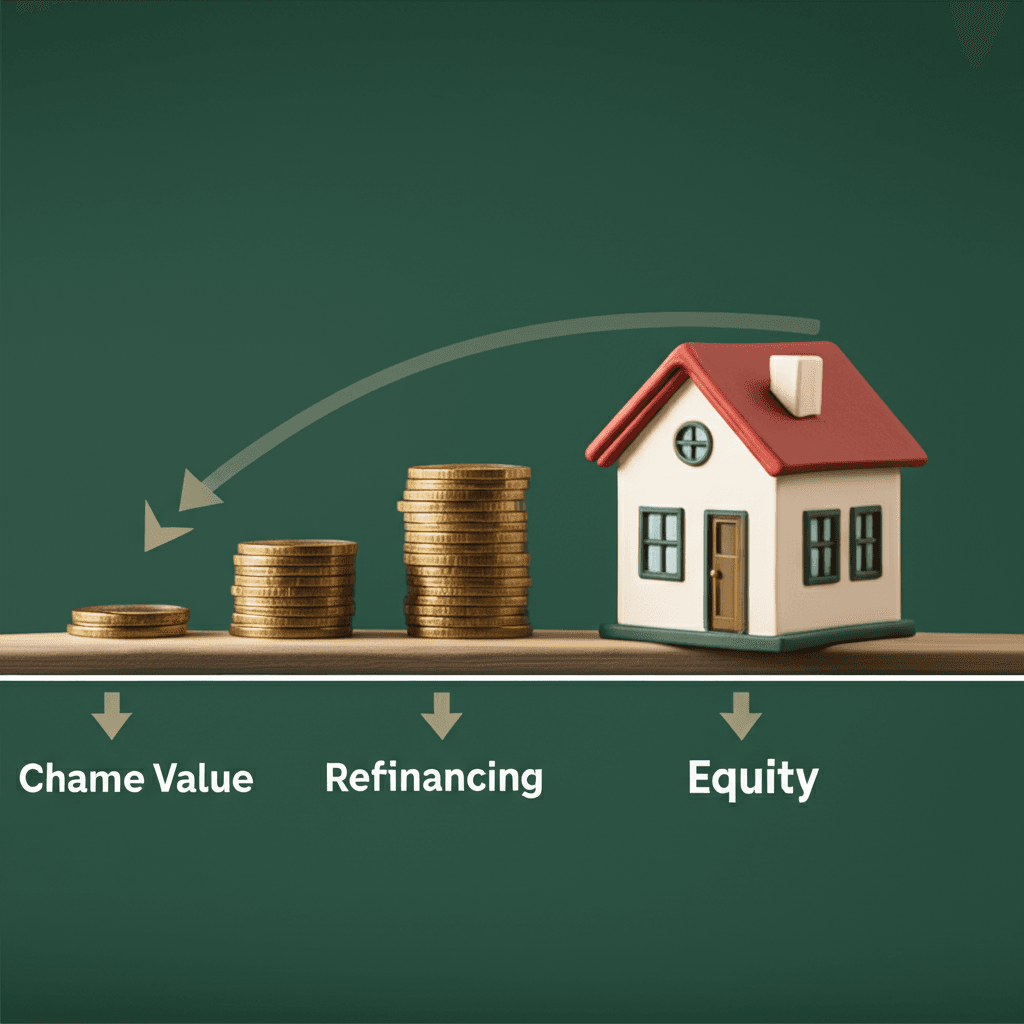

The Ultimate Strategy: Refinance, Don't Sell

The most successful long-term investors understand that the biggest secret to minimising tax is to avoid triggering CGT altogether. How do they access their profits without selling? Through refinancing.

As your property's value increases, so does your equity (the difference between the property's value and the loan amount). Instead of selling, you can approach a lender to refinance your loan based on the new, higher valuation. Lenders will typically lend up to 80% of the property's market value.

Consider a property purchased for $500,000 that is now worth $1 million. You could potentially access a significant portion of that $500,000 in equity as cash. This is a tax-free event because it's considered a loan, not income. This unlocked equity can then be used as a deposit to purchase your next investment property, allowing you to grow your portfolio without ever paying a cent in CGT. This powerful 'rinse and repeat' strategy is the cornerstone of building a multi-property portfolio.

Essential Record-Keeping for Smart Investors

To take full advantage of these strategies, meticulous record-keeping is non-negotiable. Your accountant cannot claim deductions for expenses they don't know about. From day one, keep a digital and physical file containing:

Purchase contracts and settlement statements

Loan agreements and all bank statements

Records of all borrowing expenses and legal fees

Council and water rates notices

Annual rental statements from your property manager

Receipts for any expenses you paid directly (e.g., repairs, insurance)

Tracking these in a simple spreadsheet and scanning all invoices will make tax time seamless and ensure you maximise every available deduction. For more information on your obligations, refer to the official ATO guidelines for rental property owners.

Conclusion: Tax as a Tool for Growth

Understanding Australia's property tax laws is not about tax evasion; it's about smart, strategic financial planning. By leveraging legitimate deductions, understanding the purpose of negative gearing, planning for CGT, and using equity to expand, you can transform your investment journey. These rules are the 'game' that successful investors play to secure their financial future.

Of course, every investor's situation is unique, and consulting with a qualified accountant is essential before making any major financial decisions. But armed with this knowledge, you are better equipped to build a high-performing, tax-efficient property portfolio.

The journey begins with finding the right investment property where these strategies can be most effective. HouseSeeker's powerful platform provides the insights you need to analyse market trends and identify high-potential assets. Explore our Real Estate Analytics Hub to make your next move a data-driven one.

Frequently Asked Questions

What is the difference between negative and positive gearing?

Positive gearing is when your property's rental income is higher than its deductible expenses, creating a net profit and positive cash flow. Negative gearing is when the expenses are greater than the income, creating a net loss that can be used to reduce your overall taxable income.

How long do I need to hold a property to get the 50% CGT discount?

You must own the investment property for at least 12 months from the date of the purchase contract to the date of the sale contract to be eligible for the 50% Capital Gains Tax discount.

Is the interest on my investment loan fully tax-deductible?

Yes, the interest portion of the repayments on a loan used to purchase an income-producing rental property is generally fully tax-deductible. However, if the loan was also used for private purposes (e.g., you drew down on it to buy a car), you can only claim the portion of the interest that relates to the investment property.