Australia's Housing Supply Crisis: What Buyers and Investors Need to Know

A deep dive into the data behind Australia's housing recession and how to navigate a market defined by record-low supply.

The Concept of a 'Housing Recession'

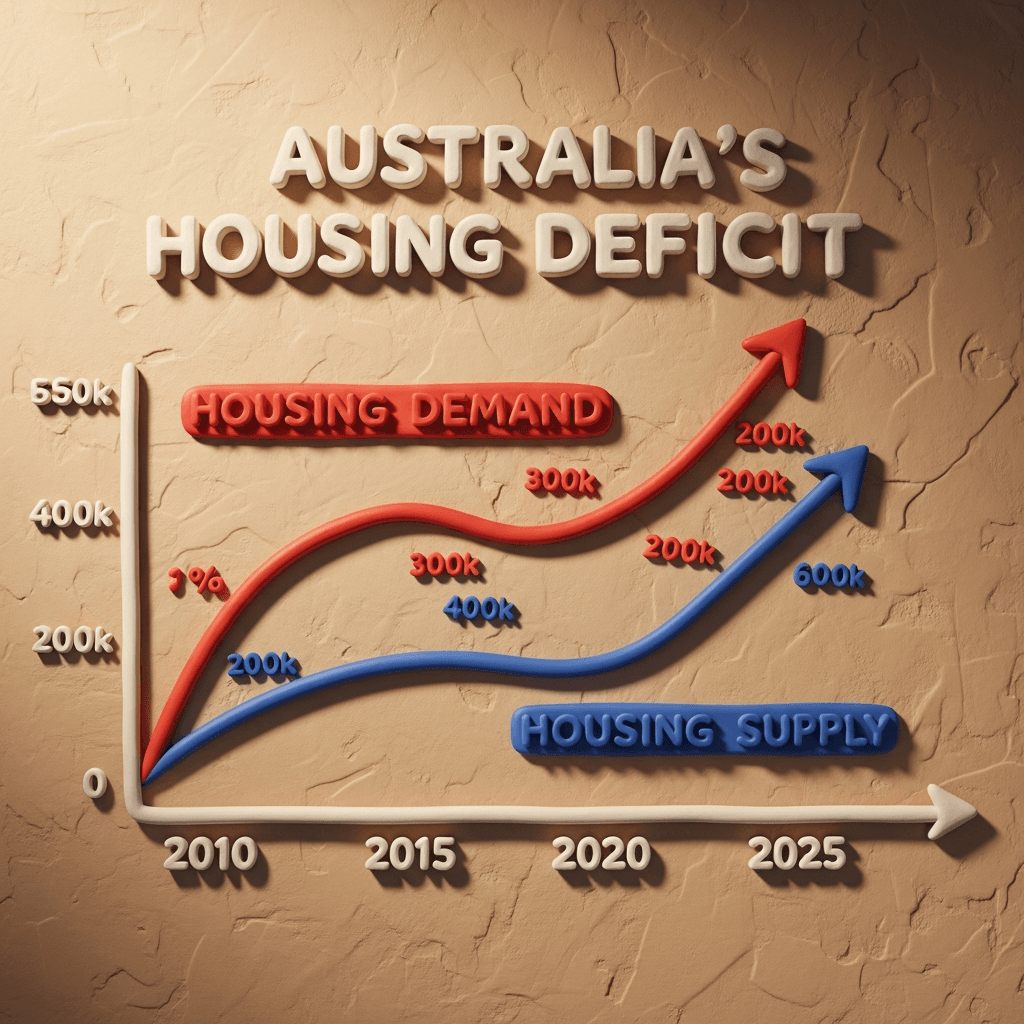

In economics, a recession typically means two consecutive quarters of declining economic growth. When applied to the property market, this concept shifts. A 'housing recession' occurs when the growth in housing supply fails to keep up with demand growth. By this metric, Australia has been in a net housing supply recession for over four years, creating significant challenges for prospective buyers and renters alike.

The Numbers Behind the Shortage

The scale of the problem is significant. According to analysis from the National Housing Supply and Affordability Council, Australia faced a housing shortage of over 137,500 homes as of July 2023. This deficit highlights a persistent gap between the number of dwellings being completed and the number of new households needing a place to live, putting continuous upward pressure on prices and rents.

Government Policy and Dwelling Completions

Despite the Albanese government making housing a central focus, the overall level of dwelling completions has remained largely stagnant since its election. Current data indicates that the proportion of public and social housing within the total dwelling stock continues to shrink. This is a notable departure from the Rudd/Gillard era, which saw a major stimulus in public housing construction that temporarily increased the non-private share of the housing stock for the first time this century.

Are Building Approvals a Sign of Hope?

Recent data on building approvals offers a glimmer of optimism, but it must be viewed with caution. The latest figures from the ABS showed a monthly rise in dwelling approvals, driven largely by the volatile non-detached housing sector. While private sector house approvals also saw a modest increase, the path to resolving the supply deficit is long. Understanding these trends requires a detailed look at the underlying figures, which is where powerful real estate analytics become invaluable for spotting genuine market shifts.

Deeper Challenges in the Construction Sector

The supply issue isn't just about approvals; it's about execution. The Australian construction sector is facing significant headwinds, including a shift from on-site labour to a more 'white-collar' workforce, which has increased costs and reduced output per worker. These deep-seated productivity challenges are significant hurdles that policy has so far struggled to address, meaning that even approved projects can face lengthy delays and budget overruns.

How to Navigate a Low-Supply Market

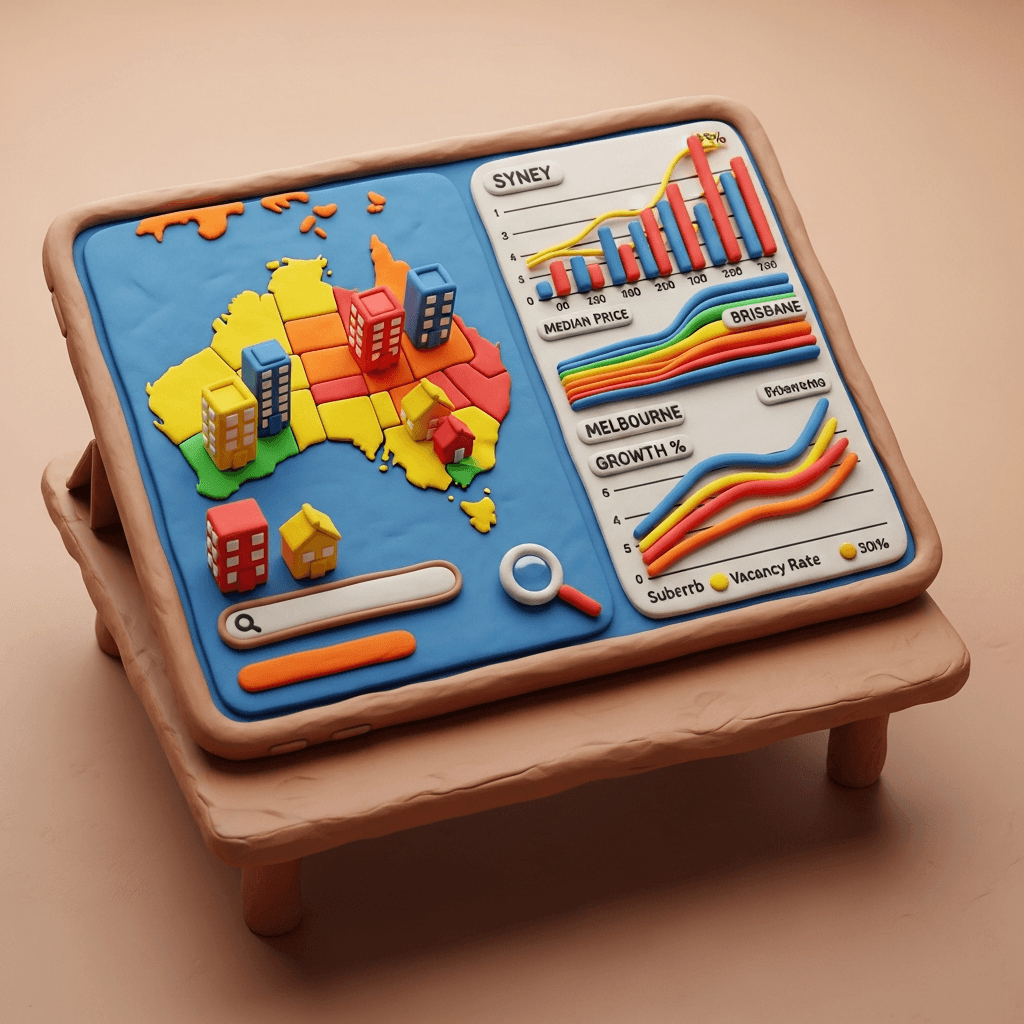

For buyers and investors, this environment demands a smarter approach. Waiting for supply to catch up is not a viable strategy. Instead, success lies in using advanced tools to uncover hidden opportunities. A sophisticated AI Property Search can help you filter the limited available stock based on specific lifestyle needs and investment criteria, while a service like an AI Buyer's Agent can provide personalised recommendations and guide you through the complex purchasing process.

Conclusion

Australia's housing supply crisis is a complex, long-term challenge rooted in insufficient construction, policy shortcomings, and productivity issues. While recent approval numbers show potential, they don't signal an immediate end to the shortage. For individuals navigating this market, the key to success is leveraging data and technology to make strategic, well-informed decisions.

Ready to cut through the market noise and find your next property with confidence? Explore HouseSeeker's advanced Real Estate Analytics Hub to gain a competitive edge.

Frequently Asked Questions

What is a 'housing recession'?

A 'housing recession' refers to a prolonged period where the construction of new homes (supply) does not meet the needs of a growing population (demand). This results in a housing shortage, leading to increased competition, rising property prices, and higher rents.

Will the housing shortage get better soon?

While there has been a recent uptick in building approvals, deep-seated issues in the construction industry, including high costs and productivity challenges, mean a quick recovery is unlikely. The housing shortage is expected to be a feature of the Australian property market for the foreseeable future.

How can I find a property in such a competitive market?

In a low-supply market, using advanced technology is crucial. AI-powered search tools can help you find properties that match precise lifestyle and financial goals, often before they gain widespread attention. Combining this with in-depth market data and analytics allows you to identify suburbs with strong growth potential and make data-backed offers.