Beyond Your First Property: The Blueprint for Scaling Your Australian Portfolio

Discover the data-driven strategies and expert systems used by the top 0.1% of investors to build lasting wealth through real estate.

The Property Investment Paradox

Buying a single property in Australia is a significant milestone, but it's a far cry from achieving true financial freedom. The challenging truth is that less than 0.1% of Australians ever succeed in building a portfolio of six or more properties—the level often associated with a self-sustaining, wealth-generating machine. Scaling a portfolio requires more than just capital; it demands a robust strategy, unwavering discipline, and a deep understanding of market dynamics. This guide breaks down the systems and mindset needed to move beyond a single property and build a scalable, high-performing portfolio.

The DIY Investor's Dilemma: Common Traps and Pitfalls

Many aspiring investors start with enthusiasm but quickly encounter significant hurdles. The path of a do-it-yourself investor is often fraught with challenges that can stall progress for years.

Analysis Paralysis: The sheer volume of conflicting advice online—from choosing the right strategy to picking the next 'hotspot'—can lead to indecision. Fear of making a mistake often results in making no move at all, which is a costly decision in a rising market.

Lack of Time and Resources: Competing against full-time professionals who analyse hundreds of properties a week is an uphill battle. A dedicated team can outwork and outmanoeuvre individual investors, securing the best deals before they even hit the public market.

Emotional Decision-Making: Buying property is an emotional process, but successful investing is purely logical. Second-guessing yourself at the final moment or buying in a location you're emotionally attached to, rather than one supported by data, can lead to underperforming assets.

The Cost of a Bad Purchase: The old adage that 'property always goes up' is a dangerous myth. The wrong property in the wrong location can stagnate for over a decade, costing you not only in interest payments but also the immense opportunity cost of tying up your capital in a non-performing asset.

The Professional Advantage: System, Strategy, and Speed

To overcome these hurdles, successful investors adopt a systematic approach, often leveraging expert teams and advanced technology. This method transforms property acquisition from a stressful gamble into a repeatable, data-driven process.

By outsourcing the process, you gain access to a team of experts who have the experience, strategies, and industry connections you may lack. This allows you to avoid common first-time investor mistakes, which can save you years of financial setbacks. An expert team provides the confidence to move quickly and decisively, a critical advantage in Australia’s competitive property market where quality assets are scarce. Without the right people and systems, you risk repeatedly missing out on opportunities or overpaying for properties.

This is where data-driven platforms become indispensable. Instead of relying on guesswork, you can use sophisticated tools to analyse market trends, forecast growth, and assess cash flow with precision. HouseSeeker’s powerful Real Estate Analytics Hub provides the critical insights needed to identify high-potential investment areas across Australia, ensuring every decision is backed by solid evidence.

Key Strategies for Sustainable Portfolio Growth

A scalable portfolio is built on a foundation of proven strategies that balance growth with sustainability. Here are a few core principles employed by savvy investors.

One of the most common mistakes is buying a 'forever home' first that doesn't meet investment criteria. The strategy of 'rentvesting' involves renting in your desired lifestyle location while buying investment properties in areas with high growth potential. This approach separates your living situation from your investment strategy, allowing you to build wealth on the property ladder without compromising your lifestyle. For example, instead of buying a multi-million dollar apartment in a metro CBD with low growth prospects, you could rent it for a fraction of the cost and use your capital to purchase multiple high-growth, positive cash-flow properties elsewhere.

While every investor's budget is different, there is a data-backed 'sweet spot' for investment-grade properties. Historically, assets in the moderate price range (e.g., $450,000 to $700,000 in the current market) often deliver the optimal balance of strong capital growth and healthy rental yields. This contrasts with buying very cheap properties that lack growth drivers or premium properties where the high entry cost limits yield and future growth potential. Focusing on established, existing properties in this range provides a repeatable system for scaling, unlike the higher risks associated with off-the-plan purchases.

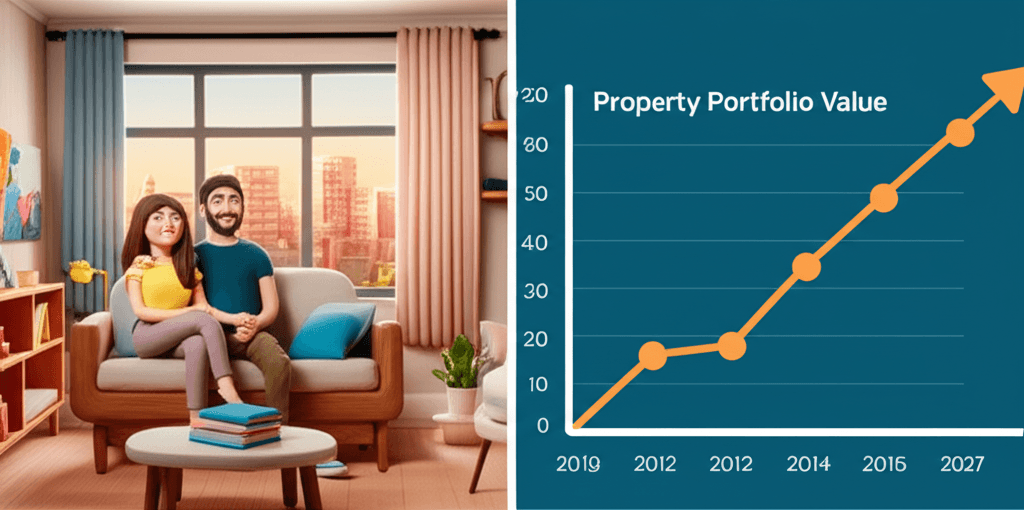

The most powerful force in wealth creation is compounding. Buying the right asset first is crucial, as its equity growth becomes the deposit for your next purchase. An initial property that grows by $100,000 in two years provides the capital to expand your portfolio. Conversely, a stagnant property traps your borrowing capacity and stalls your journey. The goal is to create a self-perpetuating machine where your portfolio's growth funds its own expansion.

Conclusion: Your Path to Financial Freedom

Scaling a property portfolio from one asset to financial independence is not about luck; it's about implementing a proven system. It requires shifting your mindset from that of a homeowner to a strategic investor. By leveraging data, focusing on high-quality assets in growth corridors, and embracing strategies like rentvesting, you can navigate the complexities of the market with confidence. While the DIY route is possible, partnering with an expert team or using advanced tools can dramatically accelerate your journey, reduce costly mistakes, and help you join the small percentage of Australians who achieve true financial freedom through property.

Ready to make data-driven decisions for your property portfolio? Explore the HouseSeeker Real Estate Analytics platform to uncover high-growth suburbs and build your investment strategy with confidence.

Frequently Asked Questions

Is it better to buy an investment property before my own home?

For many Australians, especially those living in expensive capital cities, 'rentvesting' is a powerful strategy. It allows you to enter the property market sooner by buying in a more affordable, high-growth location while you continue to rent where you prefer to live. This separates your lifestyle choices from your financial strategy, often enabling faster wealth creation than if you saved for years to buy a principal place of residence in a potentially low-growth area.

Why do so few investors succeed in scaling their portfolios?

Scaling requires a repeatable system, access to capital, and the confidence to act decisively. Many investors get stuck after their first or second property due to purchasing an underperforming asset, hitting a borrowing capacity wall, or suffering from 'analysis paralysis'. Successful investors overcome this by using data to make logical decisions, focusing on properties with both capital growth and good cash flow, and often working with a professional team to streamline the process.

How does a professional team help accelerate portfolio growth?

An expert team, such as those you can connect with through a service like an AI Buyer's Agent, provides several key advantages. They offer access to off-market deals, deep market research across the entire country, expert negotiation skills, and a streamlined due diligence process. This saves you time, reduces the risk of costly errors, and gives you the strategic guidance needed to acquire the right properties faster and with greater confidence.