A Data-Driven Guide to Investing in Brisbane's Top Suburbs for 2026

An expert analysis of Brisbane's economic powerhouse status, key growth drivers, and the 14 suburbs poised for significant growth.

The Investor's Dilemma: Where to Next?

Navigating the Australian property market requires a strategic approach, and for savvy investors, portfolio diversification is key. While Melbourne and Sydney often dominate the conversation, many are now turning their attention north to Brisbane. The question is no longer if you should consider Brisbane, but where within this booming market you should focus your attention for long-term wealth creation.

Brisbane's property market is a story of powerful economic fundamentals, structural shifts, and compelling data. Let's break down why Queensland's capital is making so much sense for investors right now and pinpoint the specific suburbs that our analysis has identified for potential outperformance leading into 2026.

The Macro Case: Why Brisbane is an Economic Powerhouse

Before drilling down to a suburb level, it's crucial to understand the economic engine driving the market. Brisbane isn't just growing; it's thriving on a scale that sets it apart from the rest of the country. The data tells a compelling story of a city with a robust and confident future.

Queensland's job market is a powerhouse. While the national employment growth rate sits around 1.8%, Queensland's is a formidable 3.0%, with Brisbane itself leading the charge at 3.3%. This isn't just numbers on a page; it's the foundation of housing demand. Strong job creation leads directly to population growth and increased demand for property. Unlike the national trend of rising unemployment, Brisbane's has been falling, signalling a healthy, confident economy where people are actively and successfully seeking work. This economic vitality is the starting point for any sound property investment strategy, and you can explore these trends further in our Data Analytics Hub.

Addressing Key Investor Concerns

Many investors express hesitation, pointing to Brisbane's recent and significant price growth. They ask, "Haven't I missed the boat?" This is where a deeper, data-led perspective is essential.

Past Growth vs. Future Potential

It's a common mistake to fixate on a single metric, like the 150% growth some pockets have seen over the last few years. While rules of thumb like 'disregard markets that have risen more than 50% in three years' exist, they often ignore the most critical factor: the underlying supply and demand dynamics. In many of Brisbane's key markets, housing supply is still critically low—in some cases, it's falling off a cliff. Simultaneously, after a brief slowdown, demand is seeing a significant uptick. When demand outstrips supply so dramatically, price pressure is the inevitable result, regardless of past performance.

Affordability: A Structural Re-Rating

Yes, Brisbane is at its most unaffordable point in 50 years when compared to its own history. This is a valid concern, but it requires context. The Brisbane of today is not the Brisbane of the past. Its economy is more diverse, its global reputation is growing with events like the Olympics on the horizon, and its land is becoming scarcer. Instead of comparing Brisbane to its past self, it's more accurate to compare it to its future potential and its national peers like Sydney. The price gap between the cities is narrowing because Brisbane is undergoing a structural shift, justifying its new status as a premier Australian capital. This isn't a temporary spike; it's a fundamental re-rating of the city's value.

The Suburb Watchlist for 2026: Where the Data Points

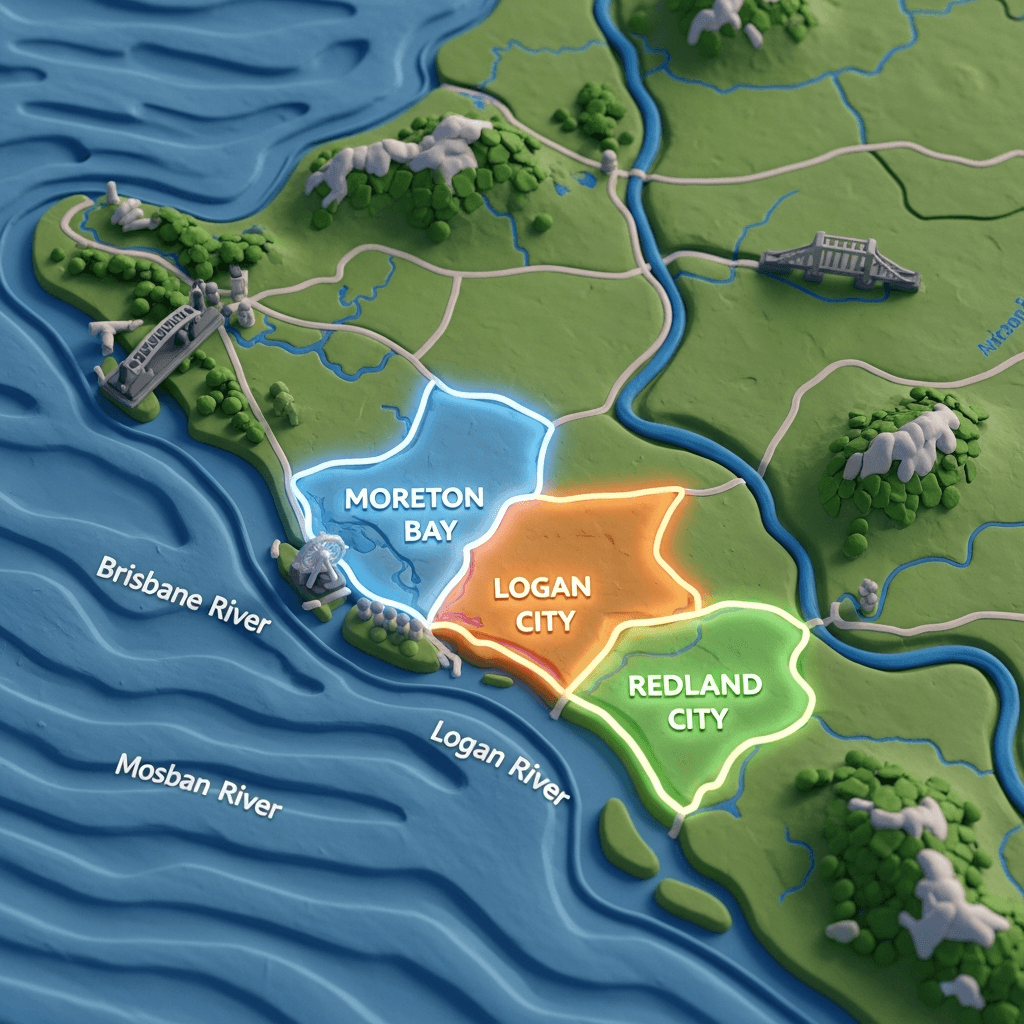

Our analysis begins at the macro level and then pinpoints specific LGAs (Local Government Areas) and suburbs where data indicates constrained supply and growing demand. We are currently focusing on three key LGAs that offer excellent fundamentals for investors.

1. Moreton Bay LGA (North): Known for its lifestyle appeal and growing infrastructure. 2. Logan LGA (South): A corridor of growth undergoing significant transformation and gentrification. 3. Redland City LGA (Bayside): A beautiful owner-occupier-driven area with strong demand.

Within these LGAs, our data has flagged the following 14 suburbs, which you can investigate further using an AI Property Search tool to filter by your specific budget and criteria.

For Budgets Under $850,000 (Freestanding Houses):

Moreton Bay: North Lakes, Murrumba Downs

Logan: Tanah Merah, Mount Warren Park, Hillcrest

For Budgets Around $900,000 - $950,000 (Freestanding Houses):

Moreton Bay: Albany Creek, Clontarf

Brisbane City: Bracken Ridge, Bald Hills

Logan: Springwood, Cornubia, Daisy Hill

Redland City: Capalaba, Alexandra Hills

Conclusion

Investing in Brisbane in 2026 is not about chasing past booms; it's about making a calculated decision based on powerful, forward-looking data. The city's economic fundamentals are exceptionally strong, driven by unparalleled job growth that fuels housing demand. While affordability is a key consideration, Brisbane is undergoing a structural transformation that justifies its new market position. The core investment thesis rests on a critical and ongoing imbalance: supply is exceptionally low, and demand is on the rise. By focusing on data-vetted LGAs and suburbs, investors can position themselves to benefit from the next wave of growth in Australia's northern powerhouse.

Ready to uncover the best investment properties in Brisbane? Explore our Data Analytics Hub to access the same suburb-level insights our experts use to identify high-growth areas.

Frequently Asked Questions

Why invest in Brisbane if prices have already risen so much?

While past growth has been strong, the decision to invest should be based on future potential. Brisbane's market is underpinned by rock-solid fundamentals, including a severe housing supply shortage, nation-leading job growth, and a structural economic shift. These factors suggest that there is still significant room for sustained growth.

Is Brisbane's property market becoming too unaffordable?

Compared to its own history, Brisbane's affordability is stretched. However, when viewed against Sydney and its own economic transformation, the prices are part of a 'new normal'. The city is being re-evaluated as a top-tier capital, and its property values are beginning to reflect that new status.

Should I only consider houses, or are units a good investment in Brisbane?

Brisbane's unit market has been one of the strongest performers in Australia. After years of oversupply and underperformance, construction halted, leading to a critical shortage. As house prices became less affordable, demand pivoted to units, causing prices to rise sharply. For investors, well-located units can offer excellent capital growth potential and stronger rental yields.