Geelong's Property Boom: Data-Driven Insights into the 2030 Population Explosion

Discover why property experts are targeting Geelong, backed by staggering population growth forecasts and powerful economic fundamentals.

The Next Property Hotspot Revealed

Identifying the next high-growth area is the holy grail for Australian property investors. While major capitals often steal the spotlight, powerful data points to a regional city poised for a significant population explosion by 2030. Property investor Dawn Fouhy, with a $10 million portfolio, has focused her research on one Victorian location that is showing all the signs of a future powerhouse: Geelong.

The Shocking Numbers: Geelong's Population Forecast

The data behind Geelong's potential is compelling. Currently home to around 300,000 people, forecasts predict a massive influx of new residents over the next five years. A CBRE report outlines a best-case scenario of the population reaching 387,000 by 2030—an increase of 87,000 people. Even the most conservative estimates project a rise to 340,000, adding 40,000 new residents. To put that in perspective, a worst-case scenario still means over 150 people are moving to Geelong every single week.

Why Geelong? The Drivers Behind the Growth

This growth isn't accidental. A study by the Regional Movers Index found Geelong captured a 9.3% share of Australia's net internal migration over the last year—surpassing even the popular Sunshine Coast. This appeal is driven by a combination of lifestyle and economic strength. Geelong is not just a suburb of Melbourne; it's a self-sufficient city with a GDP of around $20 billion. Its diverse economy is anchored by stable industries like healthcare and education, including Deakin University and a major hospital undergoing upgrades. Major infrastructure projects, such as a new $300 million convention centre and a fast rail service cutting the commute to Melbourne to just 50 minutes, are set to create hundreds of jobs and further boost its attractiveness. To explore these trends in more detail, investors can use advanced platforms like HouseSeeker's Real Estate Analytics hub.

Investment Snapshot: Prices, Yields, and Market Pressure

For investors, the numbers are attractive. The median price in the Geelong area ranges from an accessible $550,000 up to $800,000 in more premium suburbs, with rental yields sitting at a solid 4.5% to 5%. The market is already showing signs of heating up, with some properties going under contract after the very first open home. However, unlike other hotspots that have seen massive growth over the past five years, many parts of Geelong have only grown 20-30%, suggesting there is still significant upside potential for savvy investors who get in before the boom truly takes hold.

The Golden Rule: Population Growth vs. Housing Supply

A critical factor for any investor is understanding that population growth only translates to price growth when housing supply is constrained. Simply investing in a growing area is not enough if developers are building new homes faster than people are arriving. This is where granular, suburb-level analysis becomes essential to avoid areas with a flood of new housing stock that can dilute capital growth.

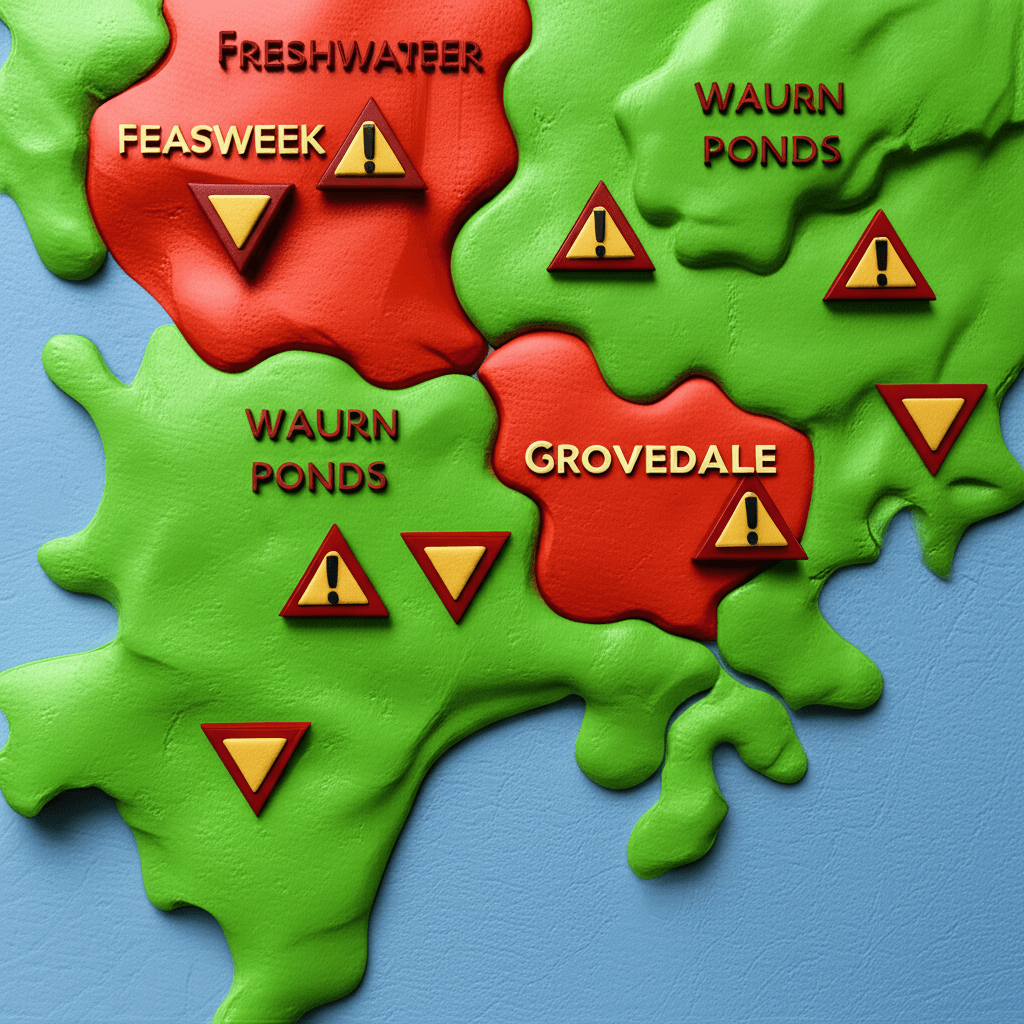

Suburb Deep Dive: Where to Buy and Where to Avoid

Not all of Geelong offers the same opportunity. Data shows extremely high building approvals in suburbs like Freshwater and Waurn Ponds—around 20%, which is nearly seven times the balanced market average of 3-4%. These are areas where oversupply could hinder price growth. In contrast, established suburbs like Grovedale offer better prospects. It's also vital to conduct on-the-ground research. A suburb like Norlane might look cheap on paper, but high concentrations of public housing can present challenges for investors seeking easygoing tenants and outperforming growth. The key is to find properties in high-demand, low-supply pockets. An AI Property Search can help filter for specific asset types in these desirable socio-economic areas.

Debunking a Common Myth: The Land-to-Asset Ratio

Many investors fixate on buying properties with a large land component (e.g., over 600 sqm), believing it's the only path to growth. However, market timing is often more critical than land size. Some of the best-performing properties during growth cycles have been on smaller blocks of 300-500 sqm in high-quality, socio-economically strong suburbs. Instead of paying a premium for a large block with a rundown house, investors can achieve excellent returns by securing a well-maintained home on a smaller lot in a desirable area where people want to live.

Conclusion

Geelong presents a compelling, data-backed case as one of Australia's next property hotspots. A perfect storm of massive population forecasts, a robust and diverse economy, significant infrastructure investment, and lifestyle appeal is creating immense potential. However, success hinges on careful, data-driven selection. By avoiding areas of oversupply and focusing on established suburbs with strong fundamentals, investors can position themselves to ride the wave of growth that is set to transform Geelong by 2030.

Ready to uncover the next property hotspot? Leverage the power of data with HouseSeeker's Real Estate Analytics tools to make smarter, more confident investment decisions.

Frequently Asked Questions

What is the predicted population growth for Geelong by 2030?

Forecasts predict Geelong's population will grow by a minimum of 40,000 people and potentially as many as 87,000 people by 2030. This translates to an influx of between 150 and 300 new residents every week.

Which suburbs in Geelong should investors be cautious about?

Investors should be wary of suburbs with very high building approval rates, such as Freshwater and Waurn Ponds, which are currently around 20%. This high level of new supply can suppress capital growth even if the broader region is growing.

Is a large block of land essential for property investment in Geelong?

No. While land is a driver of value, market timing and location quality are often more important. A house on a smaller block (300-500 sqm) in a desirable, high-socioeconomic suburb can often outperform a property on a larger block in a less appealing area.