The Great Australian Rightsizing: Are Boomers Key to Housing Supply?

Discover why 12 million spare bedrooms exist and how 'rightsizing' could reshape Australia's property landscape for every generation.

It's a conversation happening at dinner tables across the country: are Baby Boomers, with their large, often empty family homes, unintentionally holding the property market hostage? For younger generations struggling to find a foothold, it can feel that way. For the Boomers themselves, the decision to leave a home filled with decades of memories is complex and deeply personal.

This isn't about pointing fingers. It's about understanding a significant demographic shift and its profound impact on national housing supply. By unpacking the data, the motivations, and the barriers, we can move from a generational debate to a constructive conversation about 'rightsizing' for a better future for everyone.

The Boomer Factor: A Snapshot of a Generation

To understand the current landscape, we need to appreciate the scale. Australia is home to about 6.5 million Baby Boomers (generally aged 60-80), a generation that has witnessed unprecedented economic growth. Many purchased homes decades ago for what now seems like a pittance, for instance, a $30,000 house in 1980 that's worth millions today.

This incredible appreciation in value, largely untaxed on a principal place of residence, has created substantial wealth. According to the Australian Bureau of Statistics (ABS), older households hold a significant portion of the nation's property wealth. They've ridden a 40-year wave of rising prices, and now find themselves asset-rich, often rattling around in large homes long after the children have flown the coop.

The 12 Million Spare Bedroom Problem

The last census revealed a staggering statistic: Australia has 12 million spare bedrooms. A significant portion of these are in homes occupied by older couples or individuals. While every person has the right to live how they choose, this underutilisation of housing stock has massive knock-on effects in a country facing a critical housing shortage.

This isn't just an abstract number. It represents a bottleneck in the property cycle. Homes that would be perfect for growing families are kept off the market, forcing those families into smaller, less suitable accommodation or into fierce competition for limited stock. This dynamic, driven by demographic trends, is a key focus of our real estate analytics, helping buyers and sellers understand the true forces shaping their local market.

Why Stay? The Hurdles to Rightsizing

If the logic of moving seems simple, the reality is anything but. The decision is fraught with emotional, financial, and practical challenges.

Emotional and Practical Barriers

For many, the family home is more than just bricks and mortar; it's a vault of memories. Leaving the place where children grew up is a difficult emotional hurdle. Beyond sentiment, there's the overwhelming practical task of decluttering 30-40 years of accumulated possessions. As one expert noted, "the kids don’t want the stamp collection." This paralysis by analysis, where the task seems too monumental to even begin, is a major factor in their complacency.

Financial and Logistical Complexities

While homeowners may be sitting on a goldmine, accessing that wealth is complex. The process involves:

Transaction Costs: Stamp duty on a new purchase, agent fees, and legal costs can eat into the proceeds.

Tax Implications: While the main residence is exempt, selling investment properties to fund the move can trigger significant Capital Gains Tax.

Lack of Suitable Options: A major barrier is the scarcity of appropriate housing in their current communities. Many established, affluent suburbs lack medium-density townhouses or quality apartments, the very places they opposed the development of for years. Finding the perfect new home requires sophisticated search tools, like an AI property search, to filter for specific lifestyle needs.

Market Inertia and Perceived Value

With property prices proving so resilient, there's a powerful incentive to hold on. The thinking goes, "the longer I hold this asset, the more it's going to appreciate." This mindset, while logical, contributes directly to the supply shortage. Many are waiting for a market peak that may never come, anchored to a price their neighbour got during the COVID-19 boom.

The Path Forward: From 'Downsizing' to 'Rightsizing'

The narrative needs a rebrand. 'Downsizing' sounds negative, like a retreat. 'Rightsizing' is a powerful, positive alternative. It’s about proactively choosing a home that fits your current and future lifestyle, freeing up not just capital, but also time and energy spent maintaining a large, empty house.

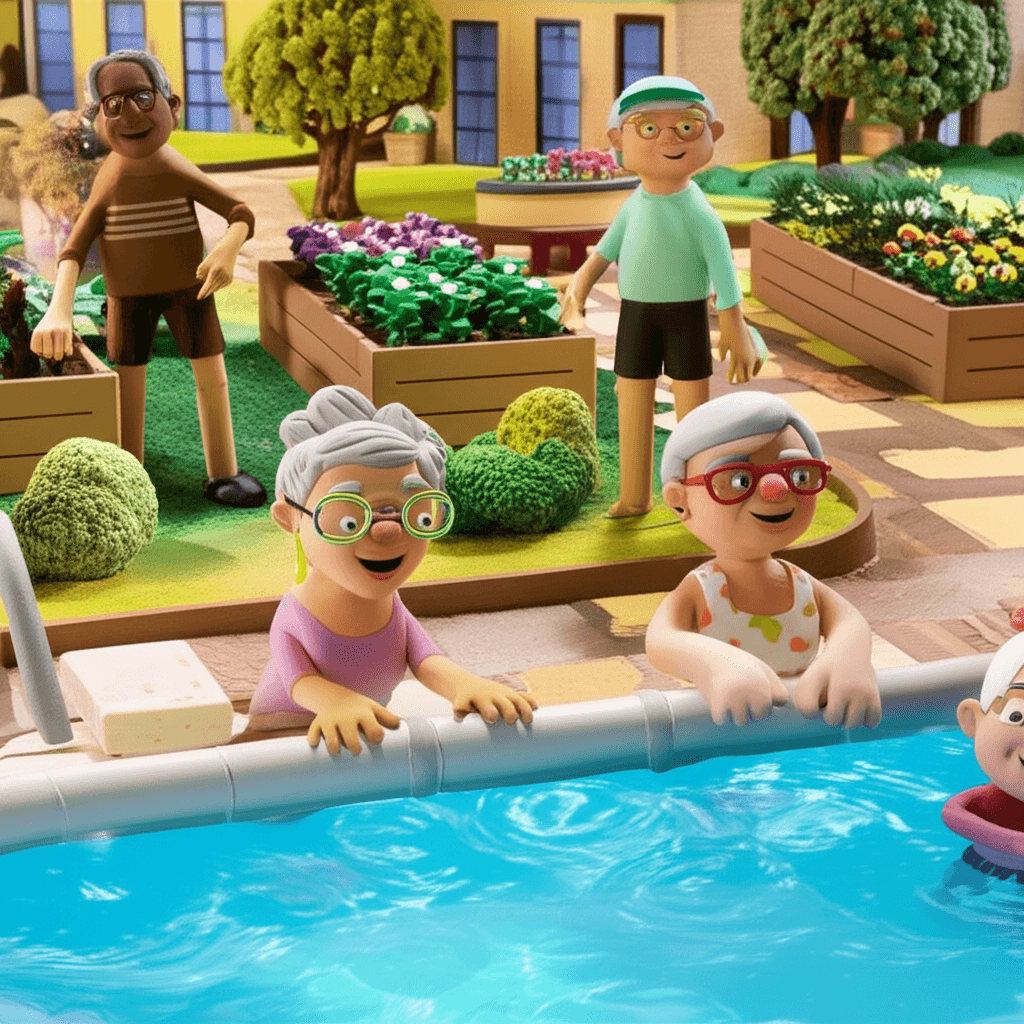

The Rise of Modern Lifestyle Communities

Today's over-50s communities are a world away from the retirement villages of the past. They are designed around placemaking and community, offering a solution to the growing issue of loneliness. With amenities like pools, cinemas, and workshops, they foster a vibrant social environment where residents form new friendships and learn new hobbies. It's about moving into a supportive community by choice, rather than being forced into care later in life.

Making an Empowered Choice

The key is to act while you still have choice and control. A major life event, like a health crisis or the loss of a spouse, can force a move under stressful circumstances. By planning 3-5 years ahead, homeowners can make an empowered decision that suits their financial goals and lifestyle aspirations. For many, this also involves freeing up equity to help their children enter the property market, creating a positive legacy for their family.

Conclusion

The presence of millions of Boomers in large family homes isn't a malicious act to block younger buyers; it's the complex result of decades of economic policy, market performance, and human emotion. However, the collective impact on housing availability is undeniable.

Reframing the conversation from 'downsizing' to 'rightsizing' is the first step. It empowers homeowners to make a positive choice for their future, unlocking a better quality of life while simultaneously freeing up desperately needed housing stock for the next generation. It's a win-win that could reshape the Australian property market for the better.

Ready to explore your next move? Understanding the deep market trends is crucial. Whether you're considering rightsizing or navigating a competitive market, our advanced tools can help. Explore HouseSeeker's real estate analytics to uncover data-driven insights and find your next opportunity.

Frequently Asked Questions

Is it always financially better for Boomers to hold onto their large homes?

Not necessarily. While the home may continue to appreciate, owners must weigh that against ongoing costs like rates, insurance, and significant maintenance. Selling can free up substantial tax-free capital to invest, improve lifestyle, travel, or help family members. The best strategy depends on individual financial circumstances and goals.

What is 'rightsizing' and how is it different from 'downsizing'?

'Downsizing' often has negative connotations of moving to something smaller and lesser. 'Rightsizing' is a positive, proactive term for choosing a home that is the perfect fit for your current stage of life. This could mean less maintenance, better access to amenities, a stronger sense of community, or a single-level layout, without compromising on quality of life.

How can data help me decide if it's the right time to sell?

Emotion and anecdotal evidence (like what a neighbour's house sold for) can cloud judgment. Objective data provides clarity. By using powerful real estate analytics, you can track sales trends in your suburb, understand buyer demand, and compare your property's value against the market. This data-driven approach removes the guesswork, helping you make a confident and timely decision.