Melbourne's Property Market: An Investor's Guide to Australia's Most Affordable Capital

Lagging price growth has created a unique buying opportunity in Melbourne. We analyse the data and what it means for savvy buyers and investors.

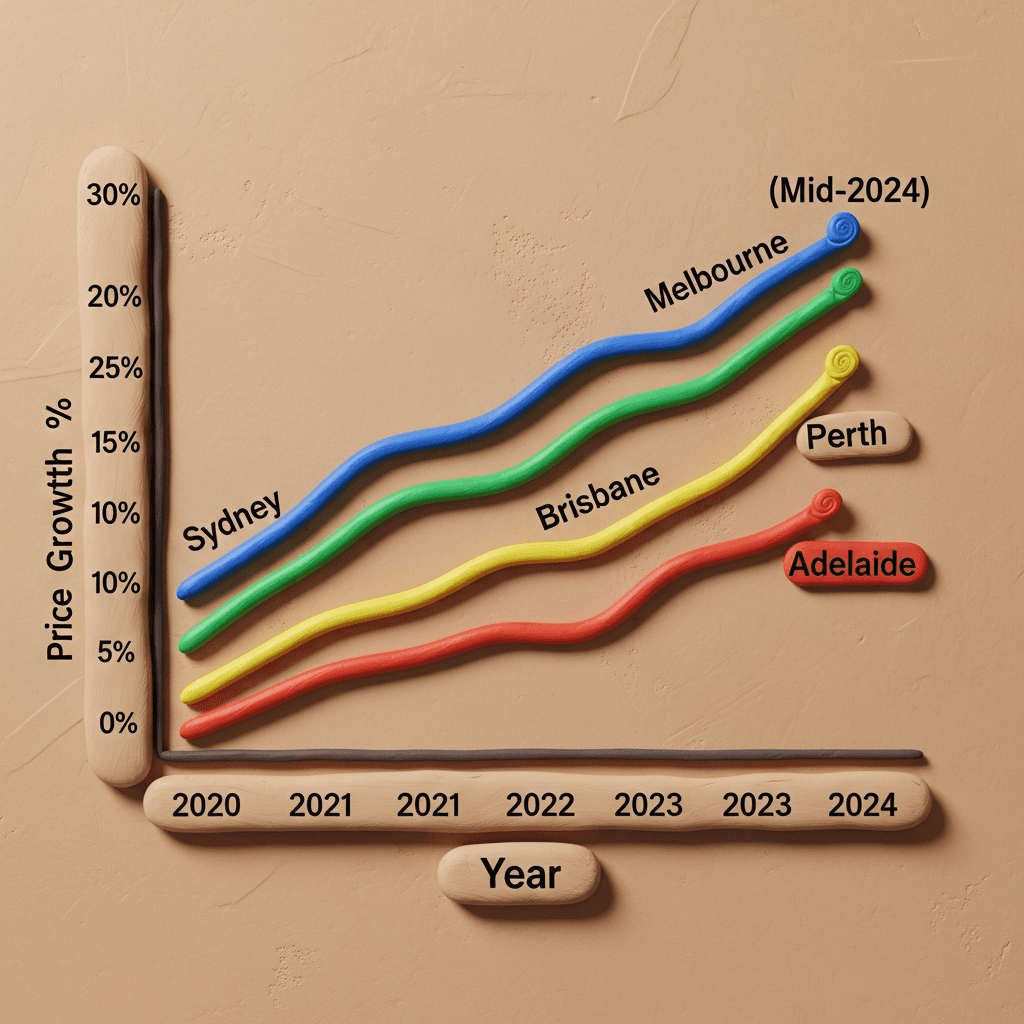

The Great Divide in Australian Property Growth

Since the beginning of the COVID-19 pandemic in March 2020, Australia's property market has seen explosive growth. However, a closer look at the data reveals a significant divergence among the major capital cities, with Melbourne lagging considerably behind its counterparts. Recent dwelling value results from PropTrack highlight this trend, showing Melbourne's values rose by a mere 2.1% in the year to August, the softest growth of any state capital.

This sluggish performance becomes even more apparent when viewed over the longer term. Since March 2020, Melbourne's property values have increased by only 20%. To put that into perspective, consider the growth in other major hubs:

Sydney: +42%

Brisbane: +96%

Perth: +99%

Adelaide: +93%

This disparity has reshaped the landscape of the national property market, creating a unique situation for potential buyers and investors looking for value.

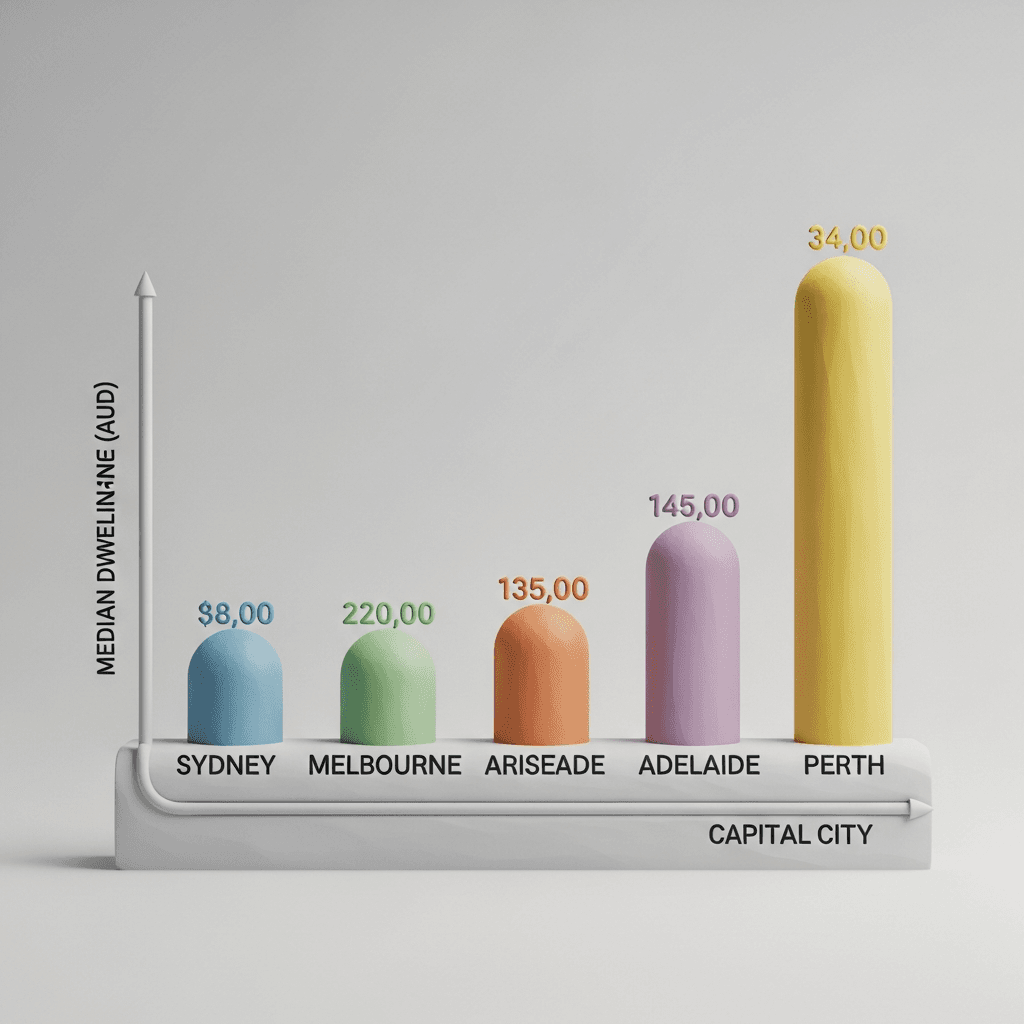

Melbourne's New Title: The Affordability King

The direct result of this subdued growth is Melbourne's newfound status as the most affordable housing market among Australia's major capital cities. According to PropTrack, Melbourne's median dwelling value stood at $830,000 in August. This figure is not only the lowest of the five major capitals but also sits a significant $108,000 (11.5%) below the combined capital city average. Historical data further illustrates this point, showing Melbourne's housing affordability is at its most favourable level in approximately 20 years. For buyers feeling priced out of other markets, Melbourne now presents a compelling alternative. Uncovering these trends is easier than ever with powerful real estate analytics platforms that process vast amounts of market data.

Are the Tides Turning for Melbourne?

While past performance has been slow, industry experts are forecasting a significant shift. Financial services firm KPMG projects Melbourne will lead the nation in price growth in 2026, with an expected rise of 6.6%—comfortably beating the national average forecast of 4.5%. This anticipated rebound is already attracting attention from 'bargain hunters' and savvy investors.

Buyer advocate Arin Russell has noted a growing trend of high-income investors, particularly from Western Australia, turning their attention to Melbourne to secure assets "before the recovery accelerates." These investors are chasing value, signalling a renewed confidence in the market's potential. Navigating such opportunities can be streamlined with tools like an AI Buyer's Agent, which helps identify properties that align with long-term growth strategies.

A Balanced View: Considering the Risks

No investment decision should be made without considering the potential downsides. It's important to acknowledge that Melbourne's market is set against a backdrop of a weaker state economy, high government debt, and growing concerns about crime. These are critical factors that any prospective buyer must weigh. However, for those with a long-term perspective, the current affordability may offer a sufficient buffer against these risks, presenting a calculated opportunity for substantial future gains.

Conclusion

The data is clear: Melbourne's property market has become an anomaly in Australia's otherwise heated real estate landscape. Its significant lag in price growth has crowned it the most affordable major capital city, creating a window of opportunity that hasn't been seen in two decades. While economic headwinds are a valid concern, strong future growth projections suggest that for savvy investors and homebuyers, Melbourne's market may be a sleeping giant about to awaken.

Ready to uncover your own property opportunity in Melbourne or beyond? Dive deep into market trends and identify high-potential suburbs with HouseSeeker's advanced real estate analytics tools.

Frequently Asked Questions

Why has Melbourne's property market grown slower than other cities?

Several factors contributed to Melbourne's slower growth, including the impact of extended COVID-19 lockdowns, subsequent population shifts to other states, and specific economic pressures facing the Victorian economy. This combination resulted in less aggressive price appreciation compared to cities like Brisbane and Perth.

Is Melbourne a good place to invest in property right now?

Melbourne currently presents a strong value proposition. Its relative affordability, coupled with expert forecasts for high future growth, makes it an attractive market for long-term investors. However, as with any investment, it's crucial to conduct thorough due diligence and consider the broader economic factors at play.

How can I find the best value properties in Melbourne?

To find high-value properties, buyers should leverage advanced technology. Using an AI-powered property search allows you to filter listings based not just on price, but also on lifestyle factors, school zones, transport links, and potential for capital growth, helping you pinpoint the best opportunities efficiently.