Perth's Red-Hot Property Market: An Expert's Guide to Supply, Value, and Opportunity

A deep dive into the critical supply shortages, investment strategies, and future forecasts shaping Western Australia's booming real estate landscape.

Introduction

The Perth property market is in overdrive. With headlines describing a "housing nightmare" and buyers facing soaring prices, many are wondering if the market is overcooked or if this is the new reality. To navigate this high-stakes environment, it's crucial to understand the underlying forces at play. We've distilled insights from property valuation expert Brendan Tommy, with nearly 30 years of experience, to provide a clear analysis of the supply crisis, investment potential, and what the future holds for Perth real estate.

Is Perth's Property Market in a 'Winner's Curse' Phase?

According to industry veterans, the current market frenzy feels eerily similar to the pre-GFC boom of 2007-08. We are in what could be described as a peak, or a "winner's curse" phase, where intense competition drives prices to extraordinary levels. This heat is fuelled by a combination of high demand, government incentives for first-home buyers, and a critical lack of available properties for sale.

The Core Problem: A Severe and Persistent Supply Shortage

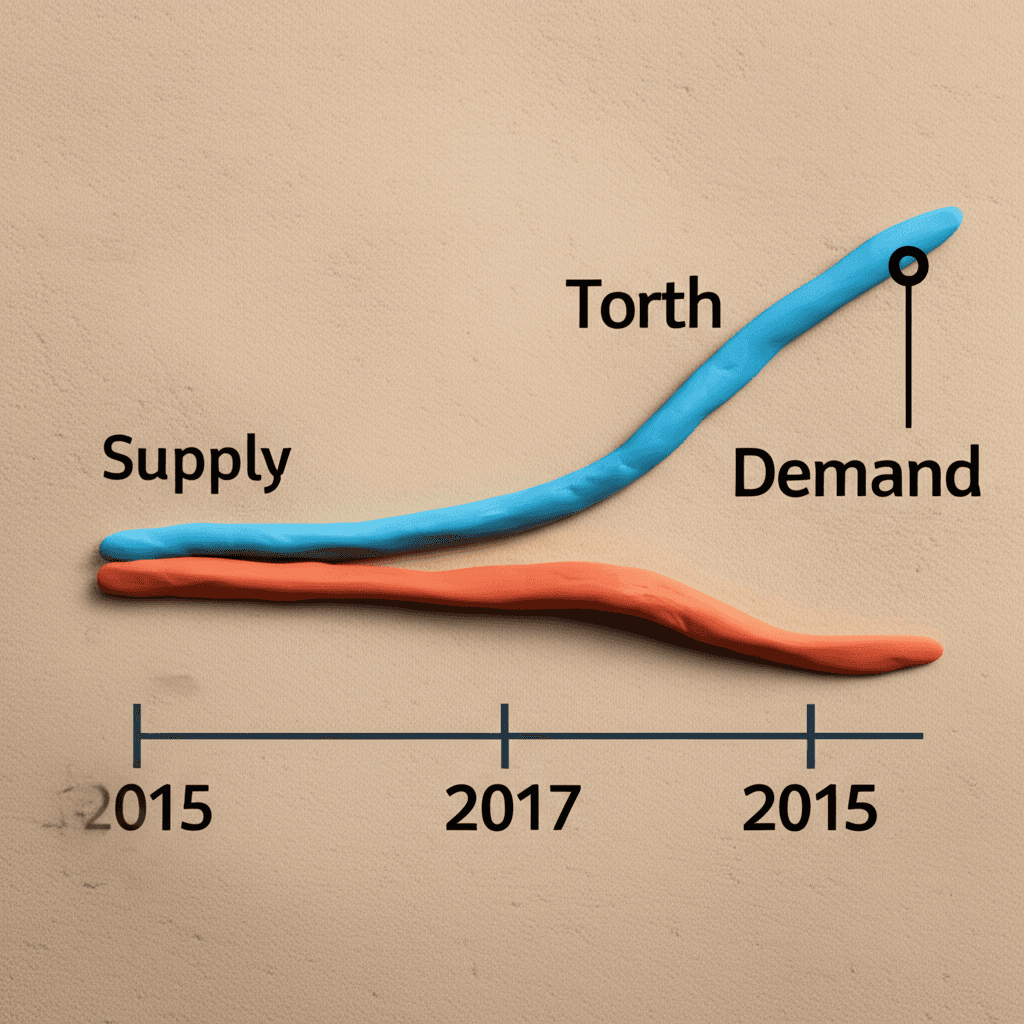

The engine driving Perth's price surge is a fundamental imbalance between supply and demand. The data is stark: in 2015, there were 16,000 listings on the market. Today, that number has plummeted to below 3,000. This isn't a temporary blip; it's a structural issue. Major builders are carefully managing new construction starts to avoid the oversupply that plagued the market in the past, and dwelling approvals have recently declined in WA, even as they rose in every other state.

This severe undersupply makes it incredibly difficult for the market to cool down. Experts believe we will remain undersupplied throughout this year and the next, with no clear path back to even 5,000 listings, let alone a balanced market. Understanding these trends requires robust real estate analytics that can track supply levels, demand indicators, and price movements in real-time.

The Apartment Development Dilemma

While building more apartments seems like an obvious solution, the economics are challenging. The cost to construct a standard apartment building is estimated at $6,000 to $8,000 per square metre. However, for a project to be feasible in the affordable-to-mid-tier market, sales rates would need to be much higher than the current $12,000 to $14,000 per square metre, especially after factoring in land acquisition and profit margins.

This feasibility gap explains why most new developments are in the luxury sector, targeting high-net-worth individuals and downsizers with sales rates from $14,000 up to $30,000 per square metre. As a result, there is virtually no pipeline of new, affordable one or two-bedroom apartments—the very stock needed to alleviate pressure in the broader market.

Expert Strategies for Perth Property Investors

In a market this hot, a smart strategy is essential. Brendan Tommy advises investors to focus on fundamental value drivers rather than getting swept up in the frenzy.

Look Beyond Gross Yield: Always factor in ongoing costs like strata fees, special levies, and future maintenance. A high gross return can be quickly eroded by unexpected expenses.

Prioritise Land Value: For your budget, aim to acquire the largest piece of land possible. Land appreciates while buildings depreciate, and a larger block offers future development potential.

Think Like a Renter: Renters prioritise lifestyle. Properties near cafe strips, public transport, the ocean, or universities will always have strong, consistent demand, underpinning your investment.

Seek Renovation Potential: Older timber-frame homes that require cosmetic or structural updates can present significant value-add opportunities for those able to undertake the work.

Finding properties with these specific attributes—like a large block near a lifestyle precinct—is where advanced tools can help. An AI-powered property search can filter for these nuanced factors beyond simple bed and bath counts.

Understanding and Navigating Property Valuations

In a rapidly moving market, contract prices can sometimes outpace recent sales evidence, leading to valuation shortfalls. It’s important to know when to challenge a valuation. If the valuer is only slightly below the contract price and the agent can provide evidence of multiple offers, there is a strong case that the price reflects true market value.

However, if the valuation is significantly lower—for example, by $100,000—it's likely a fundamental difference of opinion that won't be overturned. With over 100 groups attending a single home open, buyers need every advantage. Navigating this complexity requires deep market knowledge and a clear strategy, which is where a service like an AI Buyer's Agent can provide the data and guidance needed to make a successful purchase.

Future Outlook: What Could Slow Perth's Market?

What could finally put the brakes on this runaway market? A significant slowdown appears unlikely without a major external shock. The last major downturn was triggered by the end of the mining construction boom, which led to a mass exodus of workers. For a similar event to happen today, WA's iron ore, lithium, gold, and renewables industries would all need to collapse simultaneously—a highly improbable scenario.

The only other potential trigger would be a mass sell-off by investors. However, with Perth still offering strong growth and high confidence, there are few alternative markets that present a more compelling opportunity. For the foreseeable future, the fundamental supply-demand imbalance is set to continue.

Conclusion

The Perth property market is defined by a historic supply shortage that will continue to drive price growth for the foreseeable future. For buyers and investors, success requires looking past the hype and focusing on fundamentals: land value, lifestyle drivers, and value-add potential. Navigating this landscape is challenging, but with the right data, strategy, and expert guidance, significant opportunities remain for those prepared to make informed decisions.

Ready to make a data-backed decision in the Perth market? Explore HouseSeeker's powerful real estate analytics tools to uncover trends, compare suburbs, and find your next high-growth property.

Frequently Asked Questions

Why is Perth's property supply so low?

A combination of factors is at play, including a history of boom-bust cycles that make developers cautious, builders carefully managing new starts, a recent decline in dwelling approvals, and high construction costs that render many new apartment projects financially unfeasible.

What should an investor look for in the current Perth market?

Experts advise focusing on properties with a large land component for future growth, seeking homes with renovation potential, and prioritising strong lifestyle drivers like proximity to the coast, public transport, and amenities, as these factors underpin consistent rental demand.

Is it likely the Perth market will cool down soon?

A significant slowdown is considered unlikely without a major economic event that negatively impacts Western Australia's core resource industries. The deep-seated supply-demand imbalance is expected to persist, supporting property values for the foreseeable future.