Negative Gearing in Australia: What the Government's Stance Means for Your Property Strategy

With the Labor government confirming no changes to negative gearing, understand how this key tax policy impacts the property market and your investment decisions in 2024 and beyond.

The Unchanging Landscape of Australian Property Tax

Navigating the Australian property market requires a keen understanding of the policies that shape it. Recently, the discussion around negative gearing has once again entered the spotlight, only to be firmly settled. The Albanese government, through Housing Minister Claire O’Neil, has confirmed it will not be making any changes to this long-standing tax concession. This decision provides a degree of certainty for current and prospective property investors, making it crucial to understand its implications.

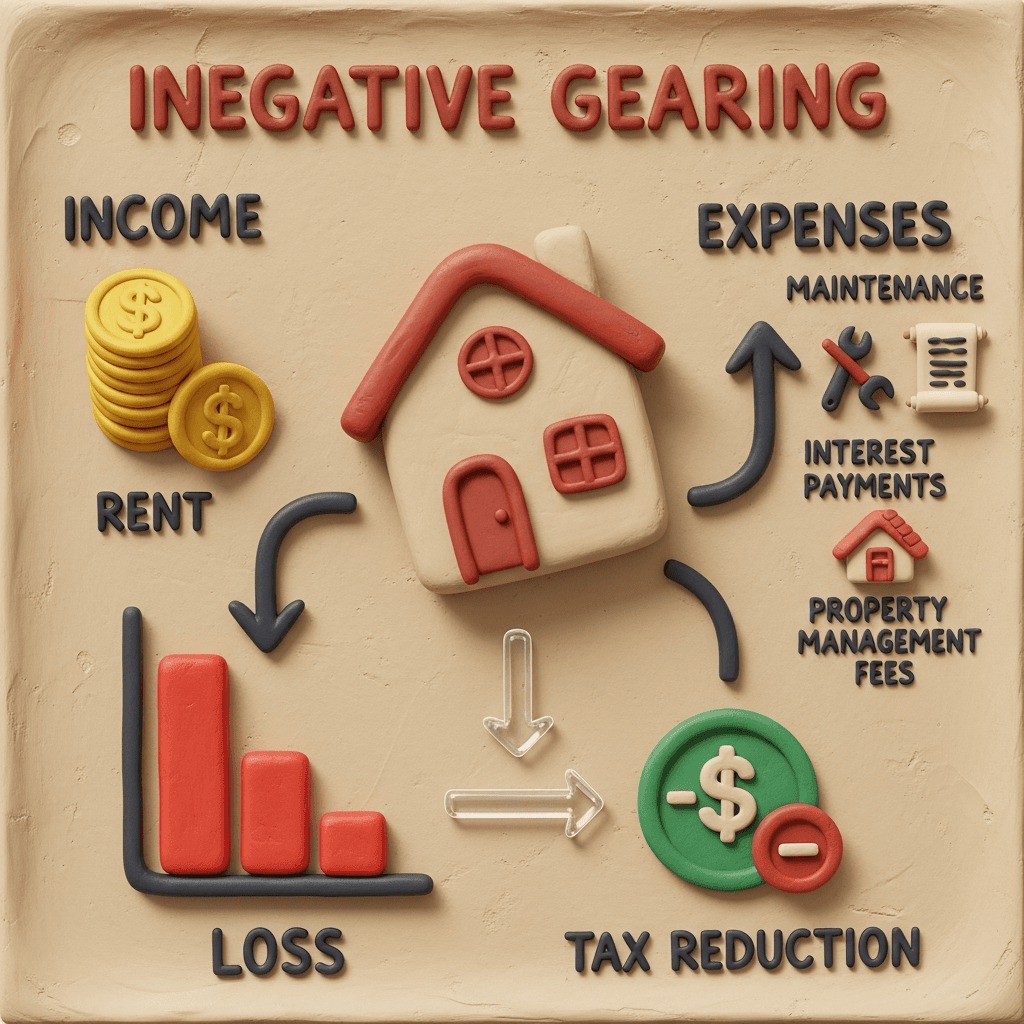

What is Negative Gearing and Why Does it Matter?

Negative gearing is a tax strategy where an investor can deduct any net loss from an investment property against their other taxable income. This situation occurs when the costs of owning the property—such as mortgage interest, maintenance, and council rates—exceed the rental income it generates. For decades, this policy has been a cornerstone of Australian property investment, encouraging private investment in the rental market. The government's decision to maintain the status quo means this strategy remains a viable and powerful tool for wealth creation through real estate.

Market Stability and Investor Confidence

The government's definitive stance offers stability in a market often swayed by political speculation. For investors, this removes the uncertainty that surrounded potential reforms proposed in previous years. With negative gearing firmly in place, investors can more confidently forecast their financial outcomes and leverage data to make informed decisions. This policy continuity supports property values, particularly in high-demand rental areas, as it sustains investor demand. To see how these trends affect specific suburbs, exploring advanced tools on the HouseSeeker Data Analytics Hub can provide invaluable insights.

How to Leverage Negative Gearing in Your Strategy

While negative gearing offers tax benefits, it shouldn't be the sole reason for an investment. A successful strategy focuses on properties with strong potential for capital growth. The tax deduction is a short-term benefit that helps manage cash flow while you wait for the long-term appreciation of your asset. By combining this tax advantage with robust market analysis—looking at factors like population growth, infrastructure development, and rental yields—you can build a resilient portfolio. Our AI Property Search can help you identify properties in areas poised for growth, aligning your search with sound investment principles.

Conclusion: A Clear Path Forward for Investors

The confirmation that negative gearing is here to stay provides a stable foundation for property investors across Australia. It reinforces the importance of a data-led approach, where understanding market trends and long-term growth potential is paramount. Rather than being distracted by political debate, investors can now focus on identifying high-quality assets that align with their financial goals. The key is to use this policy as one part of a broader, well-researched investment strategy.

Ready to find an investment property that aligns with the current market landscape? Explore real-time data and uncover hidden opportunities with the HouseSeeker Data Analytics Hub today.

Frequently Asked Questions

What does the government's decision on negative gearing mean for first-home buyers?

For first-home buyers, the continuation of negative gearing means they will continue to compete with investors for certain types of properties. However, various government incentives for first-home buyers still exist to help them enter the market. The policy's stability also contributes to a more predictable market environment.

Is a negatively geared property still a good investment?

A property should primarily be judged on its potential for capital growth and rental yield. Negative gearing is a tax benefit that can assist with holding costs, but it doesn't automatically make a poor investment a good one. A sound investment is one in a growing area that is desirable to tenants.

How can I find properties with high capital growth potential?

Identifying high-growth areas involves analysing historical data, demographic shifts, upcoming infrastructure projects, and local economic drivers. Using a platform like the HouseSeeker Data Analytics Hub provides access to comprehensive data sets and market trends, helping you make an informed decision.